Beyond sustainability

Why tomorrow’s most successful companies will be focused on leaving the planet better than we found it

At Collaborative Fund, we’ve taken our Villain Test—a measure of business viability in the eyes of the most profit-driven investors—and applied it to the burgeoning regenerative economy. As we venture deeper into 2024, we’re convinced that the companies set to lead the charge are those committed not just to sustainability but to regeneration: leaving the planet in a markedly better state than they found it.

The Five Pillars of Regenerative Success

We evaluate potential through a critical lens, asking:

Commercial traction. Does the regenerative solution have a near-term path to revenue(s)? We do this to account for a conservative context where corporations may be less willing to take a longer view on the impact of a new technology.

Scalability and repeatability. Can the solution be replicated without too much customer hand-holding? Can it serve a range of customer sizes, industries, and regions across the lifetime of the company?

Path to competitive margins. How much will it cost the company to serve these customers in the long run? Marginal costs are a constant consideration for venture backed companies, and increasingly so as it relates to climate companies.

Key stakeholder risk. Is this solution being championed by the Chief Impact Officer, or by the Chief Commercial Officer? Recognizing who the key stakeholders are that are championing the solution within customer segments is important to consider for the longevity of the solution and its integration into the everyday operations of the business.

Market Momentum. Does this solution address an emerging problem for consumers or companies? Timing is often the critical edge for a resource-limited solution amongst larger incumbents that often underestimate a growing market demand until it’s too late.

These criteria are difficult to reach, but we have seen more and more companies working on regenerative solutions (to leave the planet better than we found it) that pass our adapted Villain Test, including investments in:

Sanctu, Cyanotype Bio and MeliBio

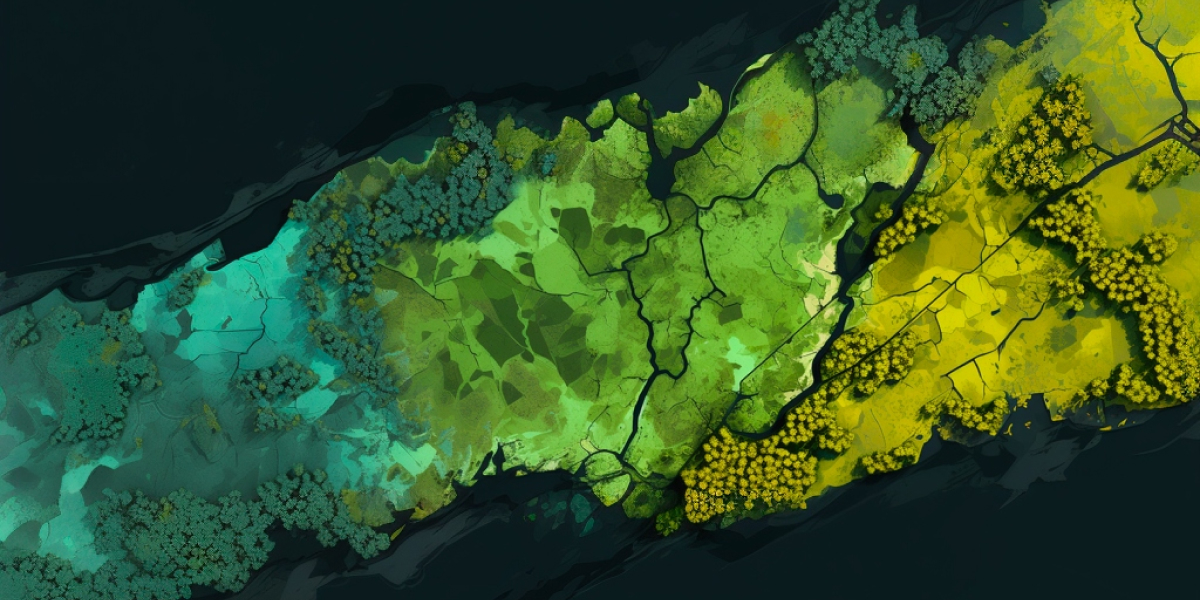

Sanctu

Sanctu enables low-income landowners from the Amazon area (e.g., in rural settlements) to multiply their income by 5x while replanting lost pieces of the largest tropical forest on earth.

Sanctu partners with them to provide financing, technical assistance, technology, logistics, and commercial effort for them to produce and sell high-integrity certified carbon credits and bioproducts (e.g., fruits, seeds, oils) to large corporations who are working on their SBTi journeys towards Net Zero (e.g., Nestlé, Natura).

After cracking the case to make climate solutions possible to small farmers from tropical areas, Sanctu can scale and restore more than the landmass of Germany of degraded land, creating unprecedented local income, prosperity and carbon capture potential (more than 1 Gigaton removed permanently).

Cyanotype Bio

Cyanotype Bio is a plant cell agriculture company creating products that increase biodiversity and protect the planet. By taking samples of rare and ethically-sourced plant tissue, Cyanotype can understand the chemical signature of the plant and develop a portfolio of products that can be used to enhance human health.

While this technology has almost limitless applications, focusing on an application that would provide near-term revenue was paramount. Cyanotype quickly identified their beachhead product: sunscreen designed to eliminate chemical run-off in sensitive aquatic environments, a customer who was willing to buy, and what would be needed to move from bench scale to pilot production. This is the traction we needed in order to gain conviction in their platform approach.

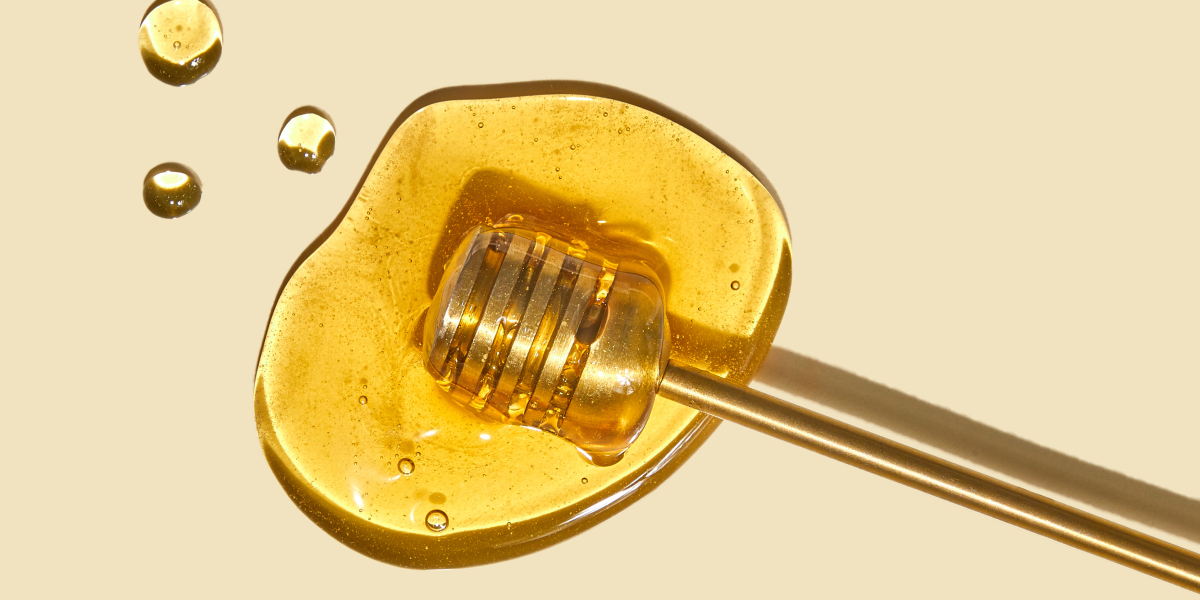

MeliBio

MeliBio provides a B2B solution for restaurants and food companies seeking to incorporate sustainable, plant-based honey into their food and beverage products. There are over 20,000 bee populations impacted by pesticides, bee farming, and climate change. MeliBio is making real honey, without the bees and therefore lowering the existential risk for the population.

MeliBio has developed a customer base across the United States, and most recently launched in Europe to offer their customers to restaurants and consumers at scale, painting a clear path to scale short term revenues and build customer loyalty.

These Collaborative Fund portfolio companies are just a few examples of businesses that have proven there is a clear path to building innovative, scalable companies focused on transitioning towards a regenerative global economy. If you are a founder with the same conviction and can pass the villain test, please don’t hesitate to reach out!