Consumer Startups Are a Great Investment. Here’s Why.

Last month, the $1 billion acquisition of Dollar Shave Club by CPG giant Unilever prompted headlines like “Who’s Next?” and brought increased investor attention to the burgeoning opportunities in early-stage consumer startups. As millennials mature and reach peak purchasing power of $200 billion, consumer demands are shifting in line with the generation’s values-oriented spending philosophy, and startups that are better equipped to innovate and meet those needs are increasingly undermining staid legacy brands.

Better Fundamental Data Leads to Lower Risk

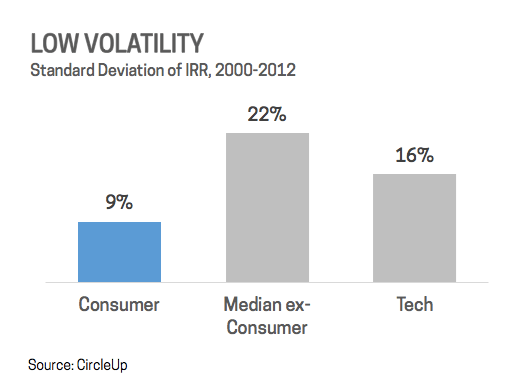

Consumer goods can offer a unique and compelling opportunity for private and institutional investors alike, even those who have historically shied away from the sector due to perceptions of lower multiples and slower growth. While consumer multiples of 1-4x do tend to be lower than, say, technology verticals, loss ratios are also typically much lower at around 25% versus 40%+ for tech.

This improved “hit rate” can be attributed to the increased transparency and better fundamental data, such as concrete revenue streams, that are a byproduct of creating a physical good. Better financial data can be a huge asset to investors when evaluating a startup. As Ryan Caldbeck, CEO of CircleUp, puts it, “this is one of the big reasons I love consumer and retail – valuations are real, driven by actual numbers, not based on hype or guesswork. In tech, on the other hand, valuations swing dramatically up and down – just look at hyped fintech these days.”

Moreover, many consumer verticals, like food & beverage or pet supplies, are resistant to market downturns (people and dogs need to eat, after all) so volatility is also typically quite low.

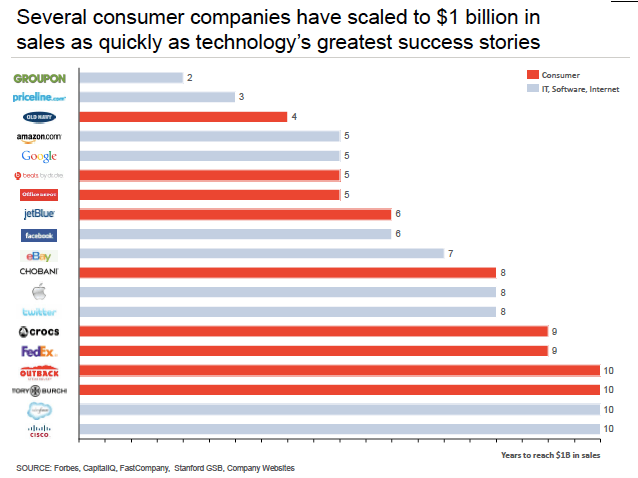

They’re Scaling Faster than Ever

And despite a perception of slow growth, these companies are scaling faster than ever. Warby Parker and The Honest Company both ballooned to $1 billion valuations in 4-5 years, just as fast as tech darlings like Uber and Whatsapp. In fact, consumers goods companies often reach key revenue benchmarks even faster than tech companies. It took just five years for Beats by Dre to hit $1 billion in sales, faster than Twitter, Apple, or even Facebook.

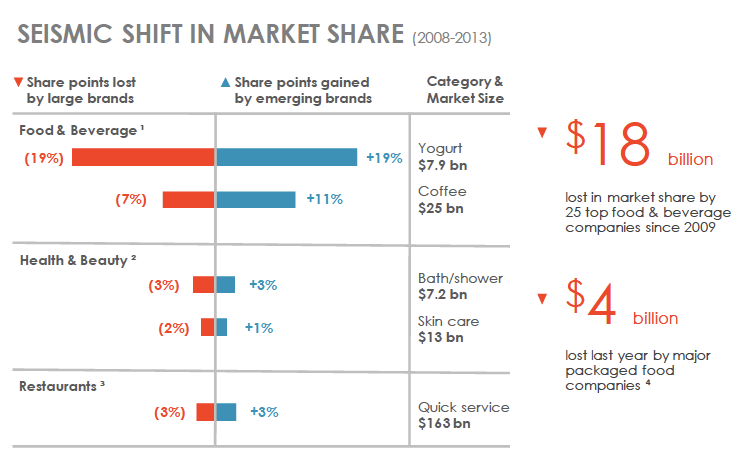

Growth Potential is in Small Brands Over Big Brands

The upside potential for consumer startups is also increasing as big brands lose market share to small brands who are better able to satisfy the demands of the new value-driven consumer. More than $18 billion in CPG sales has shifted from large to smaller companies and nearly half of the growth in the food and beverage category came from companies below the top 100 largest corporations. Increasingly, niche brands like Chobani Greek yogurt and Blue Bottle Coffee are unseating incumbents like Yoplait and Folgers.

This shift is hardly surprising. A recent Gallup study found that big business is one of the least trusted institutions in America (the only lower-ranked institution was Congress). Brand loyalty is fading at the same time that legacy companies are losing their distribution and marketing advantages to smaller internet-savvy startups.

The Environment is Ripe for M&A

Perhaps big brands could adjust strategies and innovate new products to meet these evolving market demands, but the largest CPG companies spend remarkably little capital on research and development – just 1.6% of revenue, less than one eighth of their average marketing budgets.

Instead, they are effectively outsourcing R&D by acquiring smaller brands once new methods are tested, such as Unilever acquiring Dollar Shave Club after the subscription razor model was already proven. M&A activity has been steadily increasing in both volume and frequency – the number of private exits increased by 250% between 2011 and 2015 – and I expect we are going to see more Dollar Shave Club-esque success stories in the future.

Get Involved

In the past, CPG and retail companies have been the domain of private equity firms, who often swoop in when revenues reach $10-15 million, but other investors are slowly getting in on the action. While venture capital funding to consumer goods companies is still much lower than other sectors, the number of VCs investing in the space has more than doubled over the past five years. The most sophisticated investors, whether institutional investors or individual investors, invest through investment marketplaces like CircleUp. CircleUp focuses on consumer and retail and provides investors more information and transparency than they can typically get offline.

Lower risk, rising returns, and increasing M&A activity all indicate that it’s never been a better time to invest in consumer goods startups.