Drip, Drip, Drip

“This year,” says the narrator, “thanks to Hitler and Hirohito, taxes are higher than ever before. Will you have enough money on hand to meet your payments?”

Donald Duck nods his head.

Walt Disney created several government films in the 1940s to promote wartime patriotism. One, in 1943, aimed at a particularly scary problem: Taxes were hiked several times to pay for the war, but even die-hard citizens were tempted to spend their paycheck without saving enough for an annual tax payment. “Tax debt” ballooned. As the marginal tax rate for a family with a $5,000 income rose from 8% in 1939 to 22% by 1943, getting people to save enough to pay their taxes was as big a problem as convincing them that taxes were necessary. Gallup asked Americans in 1942 if they were saving for tax payments. Less than 15% said they were.

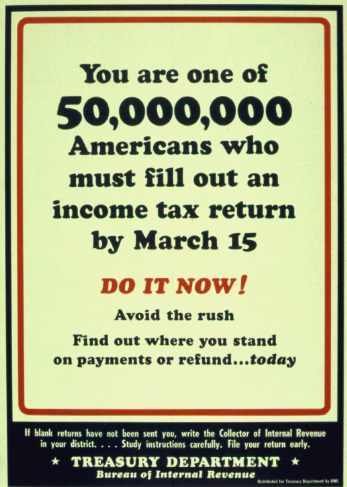

The Treasury reached for solutions. Most were public awareness campaigns like the Donald Duck video. It also plastered the country with signs like these:

Nothing worked. Historian James Sparrow writes:

In early March 1943, [Treasury secretary] Morgenthau learned that millions of new taxpayers did not know whether they had to pay income tax in a matter of days. Convening his staff, he asked a bleak rhetorical question: “Suppose we have to go out and try to arrest five million people?”

Beardsley Ruml— Macy’s treasurer and chairman of the Federal Reserve Bank of New York—finally came up with the fix. We still use it today.

Ruml’s legacy at Macy’s was promoting installment plans. The beauty of installment debt wasn’t just that consumers didn’t have to come up with the money on the spot; it was that they were willing to spend more if they could pay for it bit by bit over time. With tax rates not just rising but surging, that was important. So Ruml proposed the pay-as-you-go tax system. Employers would withhold taxes from your paycheck and send it straight to the Treasury. The employee didn’t have to save, didn’t have to write a check.

Math and psychology then did some magic. Wages surged in the 1940s as war production fueled the economy. Median wages rose 39.6% from 1940 to 1943. That easily offset the rise in taxes. And since taxes were now withheld, people’s take-home pay—what they really care about—still grew. A household in 1940 earning $5,000 a year brought home $96 a week and had to write a check for $400 in taxes every year. That hurt. By 1943 the same household was earning perhaps $122 a week and didn’t have to write a check to the Treasury because taxes were already deducted from their paychecks. That felt good.

It’s unthinkable to ask tens of millions of Americans to write a check to the Treasury every year for a fifth of their income. But once you made even higher taxes out of sight, out of mind, it’s no sweat. An underreported story of the 1940s is that one of the biggest tax increases in history went down without as much fuss as you might expect.

Drip, drip, drip. You won’t even notice.

There’s a lot of stuff that works like this.

Fidelity Investments has 27 million customers and does $18.2 billion in revenue per year. So the average Fidelity investor is paying $675 a year in fees. But almost none receive a bill or write a check. Auto-deducted fees are out of sight, out of mind. A retiree with $1M in mutual funds may be paying $10,000 a year, easily one of their biggest household expenses. Virtually all funds work like this. It’s not for bad intentions; it’s the cleanest, easiest, payment structure. But you can imagine the fireworks that would come from getting a bill in the mail from your fund manager during an underperforming year and having to write out a check. It would be pitchforks and torches.

Opportunity costs are also always out of sight, out of mind. Imagine if every investor automatically earned the returns of the most reasonable diversified portfolio that matched their time horizon and risk tolerance. Then, at the end of each, say, five-year period, those whose investments underperformed that benchmark had to write a check for the difference. You would lose your mind. You see how much your decisions cost you. More pitchforks and torches.

In each case the actual costs don’t change. But switching how you paid for them does. And it shifts your mindset from oblivious to pitchforks.

To me, this is some of the most important stuff in investing because by definition we’re not thinking about it, at least as much as we should be.

A few other important things that are easy to ignore because they’re out of sight, out of mind:

The crash or recession you were too young to experience but still impacts the outlook and decisions of other, older investors who have as much marginal market influence as you do.

The views and decisions of huge parts of the country whose economic and cultural experience barely overlaps with your own, yet whose votes count as much as yours.

The time horizon and intentions of other investors whose actions affect market prices and can dangerously influence your own decisions.

Each of these affects you whether you know it or not—and you probably don’t.