Expectations Debt

I live in Seattle, and Amazon is our giant. A third of my neighbors work for the company.

When Amazon was on top of the world in 2021 – reputation gleaming, stock price booming – you could feel the pride and prosperity. You could practically smell it.

I once heard that 90% of culture is just “winning,” – when a company is winning, everyone’s happy, rich, being promoted, and they see their work as contributing to something bigger than themselves.

That was Amazon in 2021.

Then Jeff Bezos left, the stock fell 50%, 10,000 employees were laid off, and hundreds of thousands more fear they’re next.

That is now the scent wafting around my neighborhood.

It is so clear, so obvious, how the mood has shifted.

So here’s the question: What do you call the top-of-the-world status Amazon had in 2021? Was it a gift? A reward for hard work? The natural swings of capitalism?

Yes, all of those.

But there’s another way to look at it: An expectations debt.

Expectations were so high in 2021 that investors and employees had to achieve extraordinary things just to break even. When results were merely good, they felt terrible.

Expectations are like a debt that must be repaid before you get any joy out of what you’re doing.

The hard thing is that every company and every employee wants to have what Amazon had in 2021 – winning, wealth, prestige, reputation. But look at what it led to now, after the expectations debt was repaid.

Was it worth it? Hard to say.

The Nikkei – the Japanese stock market equivalent of the Dow Jones – recently closed at its highest level since 1990.

There are two ways to look at that: As a win, or as an example of one of the worst-performing stock markets of modern times.

But here’s what’s most interesting about the Japanese stock market.

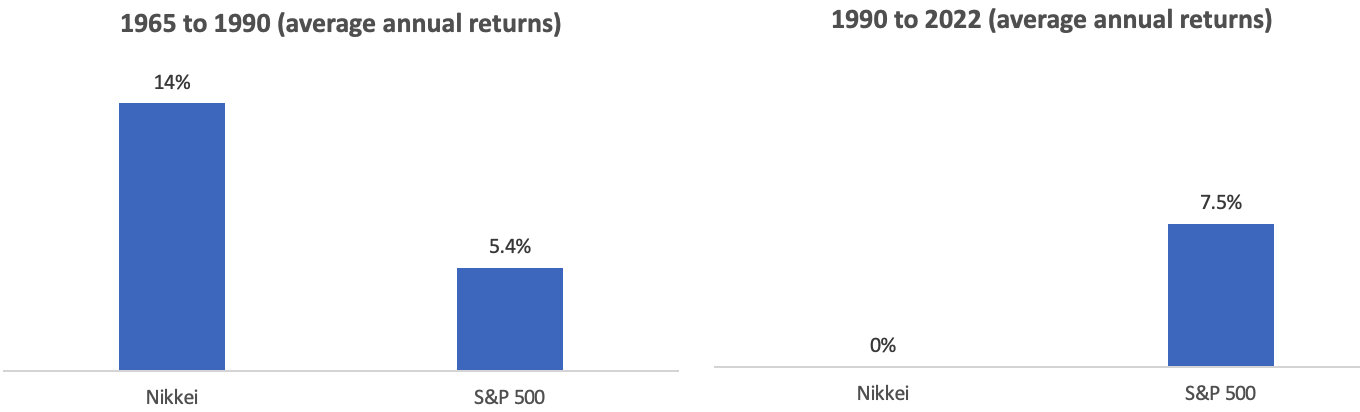

Returns over the last 33 years were terrible.

But returns from 1965 to 1990 were extraordinary.

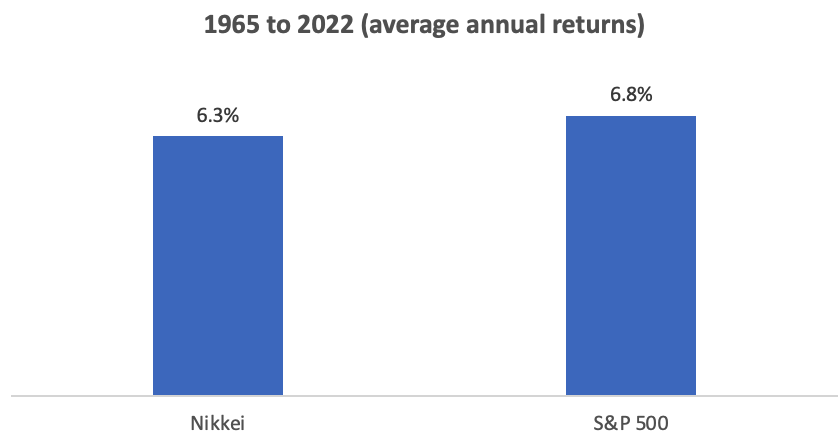

The Nikkei and the S&P 500 have had very similar returns over the last 57 years.

But the Nikkei earned all of those returns during one massive 25-year surge, while the S&P 500 has been comparatively more even.

I don’t think it’s fair to say the Japanese stock market stagnated over the last 33 years. What really happened is that 50 years of returns were stuffed into a 25-year period in the late 20th century, and the past three decades of misery has just been repaying that excess.

Here again, high expectations in 1990 were like a debt that had to be repaid before investors could benefit.

No one got a statement for that debt; it didn’t show up on anyone’s balance sheet; no one knew what the interest rate would be. But it was very real debt that anchored investors down, destroyed wealth, and took a third of a century to pay down.

An asset you don’t deserve can quickly become a liability.

Maybe your portfolio surged during a bubble, your company hit a monster valuation, or you negotiated a salary that exceeds your ability. It feels great at the time. But reality eventually catches up, and demands repayment in equal proportion to your delusions – plus interest.

These debts are easy to ignore because they are often repaid in the form of self-doubt and crushed morale. But they are very real, and when you understand their power you become careful what you wish for.

Companies should want the valuation they deserve, and not a penny more.

Workers should want a salary that matches their skill, and nothing more.

Families should want a lifestyle they can sustain, and nothing higher.

None of those are about settling or giving up. It’s about avoiding a certain kind of psychological debt that comes due when reality catches up.

There’s a stoic saying: “Misfortune weighs most heavily on those who expect nothing but good fortune.”

Expecting nothing but good feels like such a good mindset – you’re optimistic, happy, and winning. But whether you know it or not you’re very likely piling up a hidden debt that must eventually be repaid.