Getting Wealthy vs. Staying Wealthy

Good investing is not necessarily about making good decisions. It’s about consistently not screwing up.

There are a million ways to get wealthy, and plenty of books on how to do so.

But there’s only one way to stay wealthy: some combination of frugality and paranoia.

And that’s a topic we don’t discuss enough.

Let’s begin with a quick story about two investors, neither of whom knew the other, but whose paths crossed in an interesting way almost a century ago.

Jesse Livermore was the greatest stock market trader of his day. Born in 1877, he became a professional trader before most people knew you could do such a thing. By age 30 he was worth the inflation-adjusted equivalent of $100 million.

By 1929 Jesse Livermore was already one of the most well-known investors in the world. The stock market crash that year that ushered in the Great Depression cemented his legacy in history.

More than a third of the stock market’s value was wiped out in an October 1929 week whose days were later named Black Monday, Black Tuesday, and Black Thursday.

Livermore’s wife Dorothy feared the worst when her husband returned home on October 29th. Reports of Wall Street speculators committing suicide were spreading across New York. She and her children greeted Jesse at the door in tears, while her mother was so distraught she hid in another room, screaming.

Jesse, according to biographer Tom Rubython, stood confused for a few moments before realizing what was happening.

He then broke the news to his family: In a stroke of genius and luck, he had been short the market, betting stocks would decline.

“You mean we are not ruined?” Dorothy asked.

“No darling, I have just had my best ever trading day – we are fabulously rich and can do whatever we like,” Jesse said.

Dorothy ran to her mother and told her to be quiet.

In one day Jesse Livermore made the equivalent of more than $3 billion.

During one of the worst months in the history of the stock market he became one of the richest men in the world.

As Livermore’s family celebrated their unfathomable success, another man wandered the streets of New York in desperation.

Abraham Germansky was a multimillionaire real estate developer who made a fortune during the roaring 1920s. As the economy boomed, he did what virtually every other successful New Yorker did in the late 1920s: bet heavily on the surging stock market.

On October 26th, 1929, The New York Times published an article that in two paragraphs portrays a tragic ending:

Bernard H. Sandler, attorney of 225 Broadway, was asked yesterday morning by Mrs. Abraham Germansky of Mount Vernon to help find her husband, missing since Thursday Morning. Germansky, who is 50 years old and an east side real estate operator, was said by Sandler to have invested heavily in stocks.

Sandler said he was told by Mrs. Germansky that a friend saw her husband late Thursday on Wall Street near the stock exchange. According to her informant, her husband was tearing a strip of ticker tape into bits and scattering it on the sidewalk as he walked toward Broadway.

And that, as far as we know, was the end of Abraham Germansky.

Here we have a contrast.

The October 1929 crash made Jesse Livermore one of the richest men in the world. It ruined Abraham Germansky, perhaps taking his life.

But fast-forward four years and the stories cross paths again.

After his 1929 blowout Livermore, overflowing with confidence, made larger and larger bets. He wound up far over his head, in increasing amounts of debt, and eventually lost everything in the stock market.

Broke and ashamed, he disappeared for two days in 1933. His wife set out to find him. “Jesse L. Livermore, the stock market operator, of 1100 Park Avenue missing and has not been seen since 3pm yesterday,” The New York Times wrote in 1933.

He returned, but his path was set. Livermore eventually took his own life.

The timing was different, but Germansky and Livermore shared a character trait: They were both very good at getting wealthy, and equally bad at staying wealthy.

Even if “wealthy” is not a word you’d apply to yourself, the lessons from that observation apply to everyone, at all income levels.

Getting money is one thing.

Keeping it is another.

If I had to summarize money success in a single word it would be “survival.”

As we’ll see in chapter 6, 40% of companies successful enough to become publicly traded lost effectively all of their value over time. The Forbes 400 list of richest Americans has, on average, roughly 20% turnover per decade for causes that don’t have to do with death or transferring money to another family member.

Capitalism is hard. But part of the reason this happens is because getting money and keeping money are two different skills.

Getting money requires taking risks, being optimistic, and putting yourself out there.

But keeping money requires the opposite of taking risk. It requires humility, and fear that what you’ve made can be taken away from you just as fast. It requires frugality and an acceptance that at least some of what you’ve made is attributable to luck, so past success can’t be relied upon to repeat indefinitely.

Michael Moritz, the billionaire head of Sequoia Capital, was asked by Charlie Rose why Sequoia was so successful. Moritz mentioned longevity, noting that some VC firms succeed for five or ten years, but Sequoia has prospered for four decades. Rose asked why that was:

Moritz: I think we’ve always been afraid of going out of business.

Rose: Really? So it’s fear? Only the paranoid survive?

Moritz: There’s a lot of truth to that … We assume that tomorrow won’t be like yesterday. We can’t afford to rest on our laurels. We can’t be complacent. We can’t assume that yesterday’s success translates into tomorrow’s good fortune.

Here again, survival.

Not “growth” or “brains” or “insight.” The ability to stick around for a long time, without wiping out or being forced to give up, is what makes the biggest difference. This should be the cornerstone of your strategy, whether it’s in investing or your career or a business you own.

There are two reasons why a survival mentality is so key with money.

One is the obvious: few gains are so great that they’re worth wiping yourself out over.

The other, as we saw in chapter 4, is the counterintuitive math of compounding.

Compounding only works if you can give an asset years and years to grow. It’s like planting oak trees: A year of growth will never show much progress, 10 years can make a meaningful difference, and 50 years can create something absolutely extraordinary.

But getting and keeping that extraordinary growth requires surviving all the unpredictable ups and downs that everyone inevitably experiences over time.

We can spend years trying to figure out how Buffett achieved his investment returns: how he found the best companies, the cheapest stocks, the best managers. That’s hard. Less hard but equally important is pointing out what he didn’t do:

He didn’t get carried away with debt.

He didn’t panic and sell during the 14 recessions he’s lived through.

He didn’t sully his business reputation.

He didn’t attach himself to one strategy, one world view, or one passing trend.

He didn’t rely on others’ money (managing investments through a public company meant investors couldn’t withdraw their capital).

He didn’t burn himself out and quit or retire.

He survived. Survival gave him longevity. And longevity – investing consistently from age 10 to at least age 89 – is what made compounding work wonders. That single point is what matters most when describing his success.

To show you what I mean, you have to hear the story of Rick Guerin.

You’ve likely heard of the investing duo of Warren Buffett and Charlie Munger. But 40 years ago there was a third member of the group, Rick Guerin.

Warren, Charlie, and Rick made investments together and interviewed business managers together. Then Rick kind of disappeared, at least relative to Buffett and Munger’s success. Investor Mohnish Pabrai once asked Buffett what happened to Rick. Mohnish recalled:

[Warren said] “Charlie and I always knew that we would become incredibly wealthy. We were not in a hurry to get wealthy; we knew it would happen. Rick was just as smart as us, but he was in a hurry.”

What happened was that in the 1973–1974 downturn, Rick was leverered with margin loans. And the stock market went down almost 70% in those two years, so he got margin calls. He sold his Berkshire stock to Warren – Warren actually said “I bought Rick’s Berkshire stock” – at under $40 a piece. Rick was forced to sell because he was levered.

Charlie, Warren, and Rick were equally skilled at getting wealthy. But Warren and Charlie had the added skill of staying wealthy. Which, over time, is the skill that matters most.

Nassim Taleb put it this way: “Having an ‘edge’ and surviving are two different things: the first requires the second. You need to avoid ruin. At all costs.”

Applying the survival mindset to the real world comes down to appreciating three things.

1. More than I want big returns, I want to be financially unbreakable. And if I’m unbreakable I actually think I’ll get the biggest returns, because I’ll be able to stick around long enough for compounding to work wonders.

No one wants to hold cash during a bull market. They want to own assets that go up a lot. You look and feel conservative holding cash during a bull market, because you become acutely aware of how much return you’re giving up by not owning the good stuff. Say cash earns 1% and stocks return 10% a year. That 9% gap will gnaw at you every day.

But if that cash prevents you from having to sell your stocks during a bear market, the actual return you earned on that cash is not 1% a year – it could be many multiples of that, because preventing one desperate, ill-timed stock sale can do more for your lifetime returns than picking dozens of big-time winners.

Compounding doesn’t rely on earning big returns. Merely good returns sustained uninterrupted for the longest period of time – especially in times of chaos and havoc – will always win.

2. Planning is important, but the most important part of every plan is to plan on the plan not going according to plan.

What’s the saying? You plan, God laughs. Financial and investment planning are critical, because they let you know whether your current actions are within the realm of reasonable. But few plans of any kind survive their first encounter with the real world. If you’re projecting your income, savings rate, and market returns over the next 20 years, think about all the big stuff that’s happened in the last 20 years that no one could have foreseen: September 11th, a housing boom and bust that caused nearly 10 million Americans to lose their homes, a financial crisis that caused almost nine million to lose their jobs, a record-breaking stock-market rally that ensued, and a coronavirus that shakes the world as I write this.

A plan is only useful if it can survive reality. And a future filled with unknowns is everyone’s reality.

A good plan doesn’t pretend this weren’t true; it embraces it and emphasizes room for error. The more you need specific elements of a plan to be true, the more fragile your financial life becomes. If there’s enough room for error in your savings rate that you can say, “It’d be great if the market returns 8% a year over the next 30 years, but if it only does 4% a year I’ll still be OK,” the more valuable your plan becomes.

Many bets fail not because they were wrong, but because they were mostly right in a situation that required things to be exactly right. Room for error – often called margin of safety – is one of the most underappreciated forces in finance. It comes in many forms: A frugal budget, flexible thinking, and a loose timeline – anything that lets you live happily with a range of outcomes.

It’s different from being conservative. Conservative is avoiding a certain level of risk. Margin of safety is raising the odds of success at a given level of risk by increasing your chances of survival. Its magic is that the higher your margin of safety, the smaller your edge needs to be to have a favorable outcome.

3. A barbelled personality – optimistic about the future, but paranoid about what will prevent you from getting to the future – is vital.

Optimism is usually defined as a belief that things will go well. But that’s incomplete. Sensible optimism is a belief that the odds are in your favor, and over time things will balance out to a good outcome even if what happens in between is filled with misery. And in fact you know it will be filled with misery. You can be optimistic that the long-term growth trajectory is up and to the right, but equally sure that the road between now and then is filled with landmines, and always will be. Those two things are not mutually exclusive.

The idea that something can gain over the long run while being a basketcase in the short run is not intuitive, but it’s how a lot of things work in life. By age 20 the average person can lose roughly half the synaptic connections they had in their brain at age two, as inefficient and redundant neural pathways are cleared out. But the average 20 year old is much smarter than the average two year old. Destruction in the face of progress is not only possible, but an efficient way to get rid of excess.

Imagine if you were a parent and could see inside your child’s brain. Every morning you notice fewer synaptic connections in your kid’s head. You would panic! You would say, “This can’t be right, there’s loss and destruction here. We need an intervention. We need to see a doctor!” But you don’t. What you are witnessing is the normal path of progress.

Economies, markets, and careers often follow a similar path – growth amid loss.

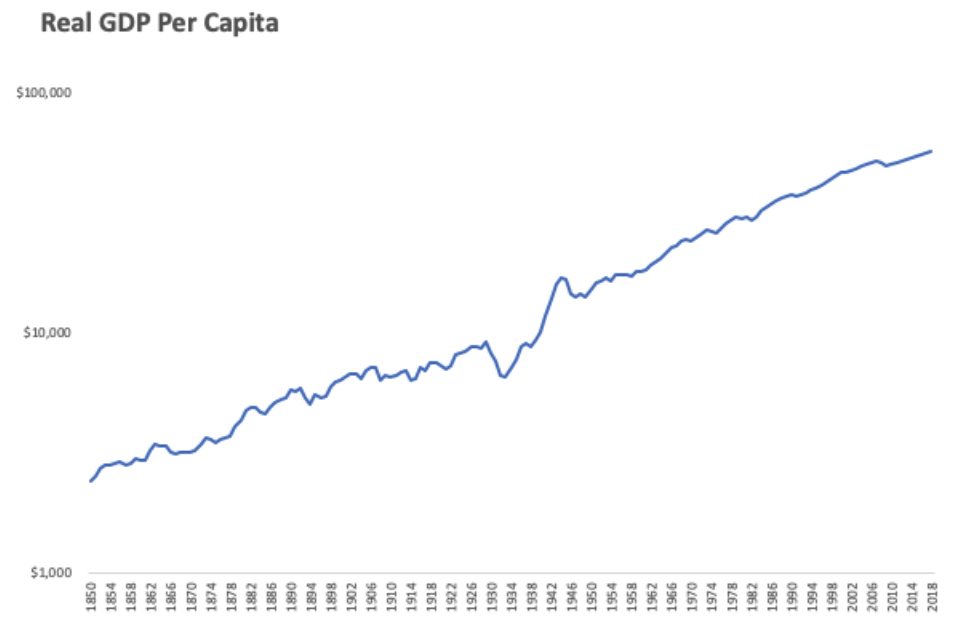

Here’s how the U.S. economy performed over the last 170 years:

But do you know what happened during this period? Where do we begin …

1.3 million Americans died while fighting nine major wars.

Roughly 99.9% of all companies that were created went out of business.

Four U.S. presidents were assassinated.

-

675,000 Americans died in a single year from a flu pandemic.

-

30 separate natural disasters killed at least 400 Americans each.

-

33 recessions lasted a cumulative 48 years.

-

The number of forecasters who predicted any of those recessions rounds to zero.

-

The stock market fell more than 10% from a recent high at least 102 times.

-

Stocks lost a third of their value at least 12 times.

-

Annual inflation exceeded 7% in 20 separate years.

-

The words “economic pessimism” appeared in newspapers at least 29,000 times, according to Google.

Our standard of living increased 20-fold in these 170 years, but barely a day went by that lacked tangible reasons for pessimism.

A mindset that can be paranoid and optimistic at the same time is hard to maintain, because seeing things as black or white takes less effort than accepting nuance. But you need short-term paranoia to keep you alive long enough to exploit long-term optimism.

Jesse Livermore figured this out the hard way.

He associated good times with the end of bad times. Getting wealthy made him feel like staying wealthy was inevitable, and that he was invincible. After losing nearly everything he reflected:

I sometimes think that no price is too high for a speculator to pay to learn that which will keep him from getting the swelled head. A great many smashes by brilliant men can be traced directly to the swelled head.

“It’s an expensive disease,” he said, “everywhere to everybody.”