How This All Happened

This is a short story about what happened to the U.S. economy since the end of World War II.

That’s a lot to unpack in 5,000 words, but the short story of what happened over the last 73 years is simple: Things were very uncertain, then they were very good, then pretty bad, then really good, then really bad, and now here we are. And there is, I think, a narrative that links all those events together. Not a detailed account. But a story of how the details fit together.

Since this is an attempt to link the big events together, it leaves out all kinds of detail of what happened during this period. I’m likely to agree with anyone who points out what I’ve missed. My goal isn’t to describe every play; it’s to look at how one game influenced the next.

If you fell asleep in 1945 and woke up in 2018 you would not recognize the world around you. The amount of growth that took place during that period is virtually unprecedented. If you learned that there have been no nuclear attacks since 1945, you’d be shocked. If you saw the level of wealth in New York and San Francisco, you’d be shocked. If you compared it to the poverty of Detroit, you’d be shocked. If you saw the price of homes, college tuition, and health care, you’d be shocked. Our politics would blow your mind. And if you tried to think of a reasonable narrative of how it all happened, my guess is you’d be totally wrong. Because it isn’t intuitive, and it wasn’t foreseeable 73 years ago.

Here’s how this all happened.

1. August, 1945. World War II ends.

Japan surrendering was “The Happiest Day in American History,” the New York Times wrote.

But there’s the saying, “History is just one damn thing after another.”

The joy of the war ending was quickly met with the question, “What happens now?”

Sixteen million Americans – 11% of the population – served in the war. About eight million were overseas at the end. Their average age was 23. Within 18 months all but 1.5 million of them would be home and out of uniform.

And then what?

What were they going to do next?

Where were they going to work?

Where were they going to live?

Those were the most important questions of the day, for two reasons. One, no one knew the answers. Two, if it couldn’t be answered quickly, the most likely scenario – in the eyes of many economists – was that the economy would slip back into the depths of the Great Depression.

Three forces had built up during the war:

-

Housing construction ground to a halt, as virtually all production capacity was shifted to building war supplies. Fewer than 12,000 homes per month were built in 1943, equivalent to less than one new home per American city. Returning soldiers faced a severe housing shortage.

-

The specific jobs created during the war – building ships, tanks, bullets, planes – were very suddenly not necessary after it, stopping with a speed and magnitude rarely seen in private business. It was unclear where soldiers could work.

-

The marriage rate spiked during and immediately after the war. Soldiers didn’t want to return to their mother’s basement. They wanted to start a family, in their own home, with a good job, right away.

This worried policymakers, especially since the Great Depression was still a recent memory, having ended just five years prior.

In 1946 the Council of Economic Advisors delivered a report to President Truman warning of “a full-scale depression some time in the next one to four years.”

They wrote in a separate 1947 memo, summarizing a meeting with Truman:

We might be in some sort of recession period where we should have to be very sure of our ground as to whether recessionary forces might be in danger of getting out of hand … There is a substantial prospect which should not be overlooked that a further decline may increase the danger of a downward spiral into depression conditions.

This fear was exacerbated by the fact that exports couldn’t be immediately relied upon for growth, as two of the largest economies – Europe and Japan – sat in ruins dealing with humanitarian crises. And America itself was buried in more debt than ever before, limiting direct government stimulus.

2. So we did something about it: Low interest rates and the intentional birth of the American consumer.

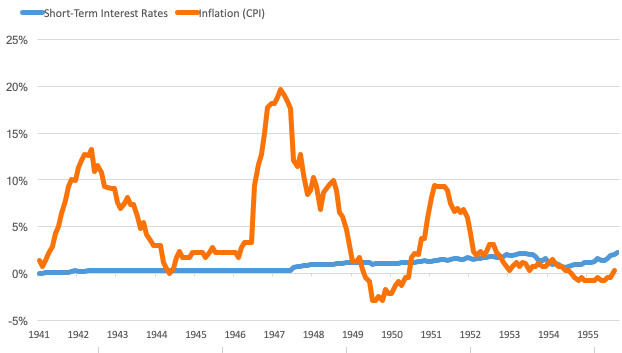

The first thing we did to keep the economy afloat after the war was keep interest rates low. This wasn’t an easy decision, because a burst of inflation when soldiers came home to a shortage of everything from clothes to cars temporarily sent inflation into double digits:

The Federal Reserve was not politically independent before 1951. The president and the Fed could coordinate policy. In 1942 the Fed announced it would keep short-term rates at 0.38% to help finance the war. Rates didn’t budge a single basis point for the next seven years. Three-month Treasury yields stayed below 2% until the mid-1950s.

The explicit reason for keeping rates down was to keep the cost of financing the equivalent of the $6 trillion we spent on the war low.

But low rates also did something else for all the returning GIs. It made borrowing to buy homes, cars, gadgets, and toys really cheap.

Which, from a paranoid policymakers’ perspective, was great. Consumption became an explicit economic strategy in the years after World War II.

An era of encouraging thrift and saving to fund the war quickly turned into an era of actively promoting spending. Princeton historian Sheldon Garon writes:

After 1945, America again diverged from patterns of savings promotion in Europe and East Asia … Politicians, businessmen and labor leaders all encouraged Americans to spend to foster economic growth.

Two things fueled this push.

One was the GI Bill, which offered unprecedented mortgage opportunities. Sixteen million veterans could buy a home often with no money down, no interest in the first year, and fixed rates so low that monthly mortgage payments could be lower than a rental.

The second was an explosion of consumer credit, enabled by the loosening of Depression-era regulations. The first credit card was introduced in 1950. Store credit, installment credit, personal loans, payday loans – everything took off. And interest on all debt, including credit cards, was tax deductible at the time.

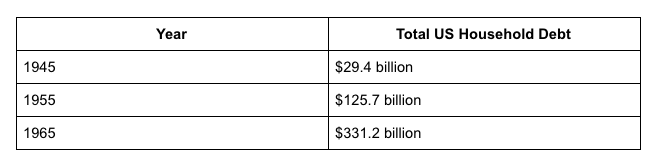

It tasted delicious. So we ate a lot of it. A simple story in a simple table:

Household debt in the 1950s grew 1.5 times faster than it did during the 2000s debt splurge.

3. Pent-up demand for stuff fed by a credit boom and a hidden 1930s productivity boom led to an economic boom.

The 1930s were the hardest economic decade in American history. But there was a silver lining that took two decades to notice: By necessity, the Great Depression had supercharged resourcefulness, productivity, and innovation.

We didn’t pay that much attention to the productivity boom in the ‘30s, because everyone was focused on how bad the economy was. We didn’t pay attention to it in the ‘40s, because everyone was focused on the war.

Then the 1950s came around and we suddenly realized, “Wow, we have some amazing new inventions. And we’re really good at making them.”

Appliances, cars, phones, air conditioning, electricity.

It was nearly impossible to buy many household goods during the war, because factories were converted to make guns and ships. That created pent-up demand from GIs for stuff after the war ended. Married, eager to get on with life, and emboldened with new cheap consumer credit, they went on a buying spree like the country had never seen.

Frederick Lewis Allan writes in his book The Big Change:

During these postwar years the farmer bought a new tractor, a corn picker, an electric milking machine; in fact he and his neighbors, between them, assembled a formidable array of farm machinery for their joint use. The farmer’s wife got the shining white electric refrigerator she had always longed for and never during the Great Depression had been able to afford, and an up-to-date washing machine, and a deep-freeze unit. The suburban family installed a dishwashing machine and invested in a power lawnmower. The city family became customers of a laundromat and acquired a television set for the living room. The husband’s office was air-conditioned. And so on endlessly.

It’s hard to overstate how big this surge was.

Commercial car and truck manufacturing virtually ceased from 1942 to 1945. Then 21.4 million cars were sold from 1945 to 1949. Another 37 million were sold by 1955.

1.9 million homes were built from 1940 to 1945. Then 7 million were built from 1945 to 1950. Another 8 million were built by 1955.

Pent-up demand for stuff, and our newfound ability to make stuff, created the jobs that put returning GIs back to work. And they were good jobs, too. Mix that with consumer credit, and America’s capacity for spending exploded.

The Federal Reserve wrote to President Truman in 1951: “By 1950, total consumer expenditures, together with residential construction, amounted to about 203 billion dollars, or in the neighborhood of 40 percent above the 1944 level.”

The answer to the question, “What are all these GIs going to do after the war?” was now obvious. They were going to buy stuff, with money earned from their jobs making new stuff, helped by cheap borrowed money to buy even more stuff.

4. Gains are shared more equally than ever before.

The defining characteristic of economics in the 1950s is that the country got rich by making the poor less poor.

Average wages doubled from 1940 to 1948, then doubled again by 1963.

And those gains focused on those who had been left behind for decades before. The gap between rich and poor narrowed by an extraordinary amount.

Lewis Allan wrote in 1955:

The enormous lead of the well-to-do in the economic race has been considerably reduced.

It is the industrial workers who as a group have done best – people such as a steelworker’s family who used to live on $2,500 and now are getting $4,500, or the highly skilled machine-tool operator’s family who used to have $3,000 and now can spend an annual $5,500 or more.

As for the top one percent, the really well-to-do and the rich, whom we might classify very roughly indeed as the $16,000-and-over group, their share of the total national income, after taxes, had come down by 1945 from 13 percent to 7 percent.

This was not a short-term trend. Real income for the bottom 20% of wage-earners grew by a nearly identical amount as the top 5% from 1950 to 1980.

The equality went beyond wages.

Women held jobs outside the home in record numbers. Their labor force participation rate went from 31% after the war to 37% by 1955, and to 40% by 1965.

Minorities gained, too. After the 1945 inauguration Eleanor Roosevelt wrote about an African American reporter who told her:

Do you realize what twelve years have done? If at the 1933 reception a number of colored people had gone down the line and mixed with everyone else in the way they did today, every paper in the country would have reported it. We do not even think it is news and none of us will mention it.

Women and minority rights were still a fraction of what they are today. But the progress toward equality in the late ‘40s and ‘50s was extraordinary.

The leveling out of classes meant a leveling out of lifestyles. Normal people drove Chevys. Rich people drove Cadillacs. TV and radio equalized the entertainment and culture people enjoyed regardless of class. Mail-order catalogs equalized the clothes people wore and the goods they bought regardless of where they lived. Harper’s Magazine noted in 1957:

The rich man smokes the same sort of cigarettes as the poor man, shaves with the same sort of razor, uses the same sort of telephone, vacuum cleaner, radio, and TV set, has the same sort of lighting and heating equipment in his house, and so on indefinitely. The differences between his automobile and the poor man’s are minor. Essentially they have similar engines, similar fittings. In the early years of the century there was a hierarchy of automobiles.

Paul Graham wrote in 2016 about what something as simple as there only being three TV stations did to equalize culture:

It’s difficult to imagine now, but every night tens of millions of families would sit down together in front of their TV set watching the same show, at the same time, as their next door neighbors. What happens now with the Super Bowl used to happen every night. We were literally in sync.

This was important. People measure their well being against their peers. And for most of the 1945-1980 period, people had a lot of what looked like peers to compare themselves to. Many people – most people – lived lives that were either equal or at least fathomable to those around them. The idea that people’s lives equalized as much as their incomes is an important point of this story we’ll come back to.

5. Debt rose tremendously. But so did incomes, so the impact wasn’t a big deal.

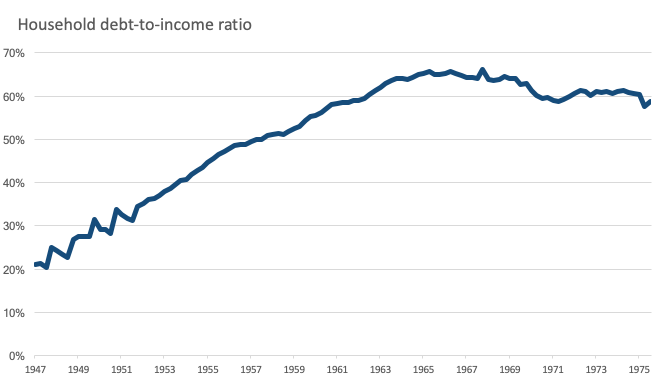

Household debt increased 5-fold from 1947 to 1957 due to the combination of the new consumption culture, new debt products, and interest rates subsidized by government programs and held low by the Federal Reserve.

But income growth was so strong during this period that the impact on households wasn’t severe. And household debt was so low to begin with after the war. The Great Depression wiped out a lot of it, and household spending was so curtailed during the war that debt accumulation was restricted – that the growth in household debt-to-income was manageable.

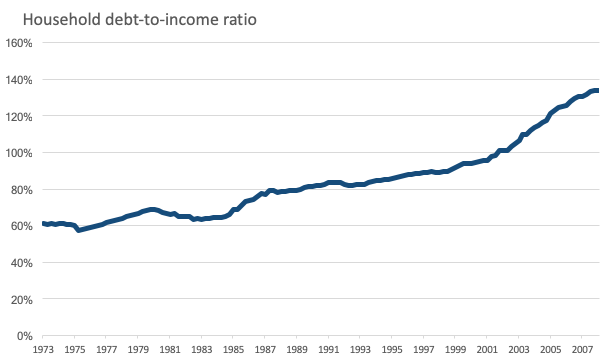

Household debt to income today is just over 100%. Even after rising in the 1950s, 1960s, and 1970s, it stayed below 60%:

Driving a lot of this debt boom was a surge in home ownership.

The homeownership rate in 1900 was 46.5%. It stayed right about there for the next four decades. Then it took off, hitting 53% by 1945 and 62% by 1970. A substantial portion of the population was now in debt that, in previous generations, would not – could not – use it. And they were mostly OK with it.

David Halberstam writes in his book The Fifties:

They were confident in themselves and their futures in a way that [those] growing up in harder times found striking. They did not fear debt as their parents had … They differed from their parents not just in how much they made and what they owned but in their belief that the future had already arrived. As the first homeowners in their families, they brought a new excitement and pride with them to the store as they bought furniture or appliances — in other times young couples might have exhibited such feelings as they bought clothes for their first baby. It was as if the very accomplishment of owning a home reflected such an immense breakthrough that nothing was too good to buy for it.

Now’s a good time to connect a few things, as they’ll become increasingly important:

-

America is booming.

-

It’s booming together like never before.

-

It’s booming with debt that isn’t a big deal at the time because it’s still low relative to income and there’s a cultural acceptance that debt isn’t a scary thing.

6. Things start cracking.

1973 was the first year where it became clear the economy was walking down a new path.

The recession that began that year brought unemployment to the highest it had been since the 1930s

Inflation surged. But unlike the post-war spikes, it stayed high.

Short-term interest rates hit 8% in 1973, up from 2.5% a decade earlier.

And you have to put all of that in the context of how much fear there was between Vietnam, riots, and the assassinations of Martin Luther King, John and Bobby Kennedy.

It got bleak.

America dominated the world economy in the two decades after the war. Many of the largest countries had their manufacturing capacity bombed into rubble. But as the 1970s emerged, that changed. Japan was booming. China’s economy was opening up. The Middle East was flexing its oil muscles.

A combination of lucky economic advantages and a culture shared by the Greatest Generation shared – hardened by the Depression and anchored in systematic cooperation from the war – shifted when Baby Boomers began coming of age. A new generation that had a different view of what’s normal and expected hit at the same time a lot of the economic tailwinds of the previous two decades ended.

Everything in finance is data within the context of expectations. One of the biggest shifts of the last century happened when the economic winds began blowing in a different, uneven direction, but people’s expectations were still rooted in a post-war culture of equality. Not necessarily equality of income, although there was that. But equality in lifestyle and consumption expectations; the idea that someone earning a 50th percentile income shouldn’t live a life dramatically different than someone in the 80th or 90th percentile. And that someone in the 99th percentile lived a better life, but still a life that someone in the 50th percentile could comprehend. That’s how America worked for most of the 1945-1980 period. It doesn’t matter whether you think that’s morally right or wrong. It just matters that it happened.

Expectations always move slower than facts. And the economic facts of the years between the early 1970s through the early 2000s were that growth continued, but became more uneven, yet people’s expectations of how their lifestyle should compare to their peers did not change.

7. The boom resumes, but it’s different than before.

Ronald Reagan’s 1984 Morning in America ad declared:

It’s morning again in America. Today more men and women will go to work than ever before in our country’s history. With interest rates at about half the record highs of 1980, nearly 2,000 families today will buy new homes, more than at any time in the past four years. This afternoon 6,500 young men and women will be married, and with inflation at less than half of what it was just four years ago, they can look forward with confidence to the future.

That wasn’t hyperbole. GDP growth was the highest it had been since the 1950s. By 1989 there were 6 million fewer unemployed Americans than there were seven years before. The S&P 500 rose almost four-fold between 1982 and 1990. Total real GDP growth in the 1990s was roughly equal to that of the 1950s – 40% vs. 42%.

President Clinton boasted in his 2000 State of the Union speech:

We begin the new century with over 20 million new jobs; the fastest economic growth in more than 30 years; the lowest unemployment rates in 30 years; the lowest poverty rates in 20 years; the lowest African-American and Hispanic unemployment rates on record; the first back-to-back surpluses in 42 years; and next month, America will achieve the longest period of economic growth in our entire history. We have built a new economy.

His last sentence was important. It was a new economy. The biggest difference between the economy of the 1945-1973 period and that of the 1982-2000 period was that the same amount of growth found its way into totally different pockets.

You’ve probably heard these numbers but they’re worth rehashing. The Atlantic writes:

Between 1993 and 2012, the top 1 percent saw their incomes grow 86.1 percent, while the bottom 99 percent saw just 6.6 percent growth.

Joseph Stiglitz in 2011:

While the top 1 percent have seen their incomes rise 18 percent over the past decade, those in the middle have actually seen their incomes fall. For men with only high-school degrees, the decline has been precipitous—12 percent in the last quarter-century alone.

It was nearly the opposite of the flattening that occurred after that war.

Why this happened is one of the nastiest debates in economics, topped only by the debate over what we should do about it. Lucky for this article neither matters.

All that matters is that sharp inequality became a force over the last 35 years, and it happened during a period where, culturally, Americans held onto two ideas rooted in the post-WW2 economy: That you should live a lifestyle similar to most other Americans, and that taking on debt to finance that lifestyle is acceptable.

8. The Big Stretch

Rising incomes among a small group of Americans led to that group breaking away in lifestyle.

They bought bigger homes, nicer cars, went to expensive schools, and took fancy vacations.

And everyone else was watching – fueled by Madison Avenue in the ‘80s and ‘90s, and the internet after that.

The lifestyles of a small portion of legitimately rich Americans inflated the aspirations of the majority of Americans, whose incomes weren’t rising.

A culture of equality and Togetherness that came out of the 1950s-1970s innocently morphs into a Keeping Up With The Joneses effect.

Now you can see the problem.

Joe, an investment banker making $900,000 a year, buys a 4,000 square foot house with two Mercedes and sends three of his kids to Pepperdine. He can afford it.

Peter, a bank branch manager making $80,000 a year, sees Joe and feels a subconscious sense of entitlement to live a similar lifestyle, because Peter’s parents believed – and instilled in him – that Americans’ lifestyles weren’t that different even if they had different jobs. His parents were right during their era, because incomes fell into a tight distribution. But that was then. Peter lives in a different world. But his expectations haven’t changed much from his parents, even if the facts have.

So what does Peter do?

He takes out a huge mortgage. He has $45,000 of credit card debt. He leases two cars. His kids will graduate with heavy student loans. He can’t afford the stuff Joe can, but he’s pushed to stretch for the same lifestyle. It is a big stretch.

This would have seemed preposterous to someone in the 1930s. But we’ve spent a half-century since the end of the war fostering a cultural acceptance of household debt.

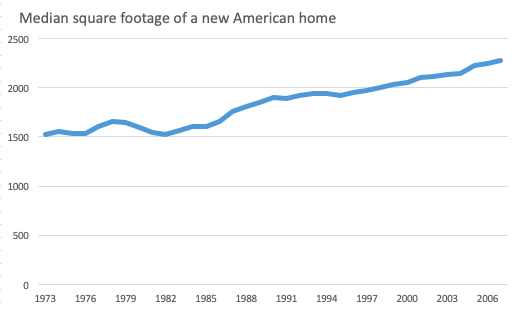

During a time when median wages were flat, the median new American home grew 50% larger:

The average new American home now has more bathrooms than occupants. Nearly half have four or more bedrooms, up from 18% in 1983.

The average car loan adjusted for inflation more than doubled between 1975 and 2003, from $12,300 to $27,900.

And you know what happened to college costs and student loans.

Household debt-to-income stayed about flat from 1963 to 1973. Then it climbed, and climbed, and climbed:

Even as interest rates plunged, the percentage of income going to debt service payments rose. And it skewed toward lower-income groups. The share of income going toward debt and lease payments is just over 8% for the highest income groups – those with the biggest income gains – but over 21% for those below the 50th percentile.

The difference between this climb and the debt increase that took place during the 1950s and ‘60s is that the recent jump started from a high base.

Economist Hyman Minsky described the beginning of debt crises: The moment when people take on more debt than they can service. It’s an ugly, painful moment. It’s like Wile E. Coyote looking down, realizing he’s screwed, and falling precipitously.

Which, of course, is what happened in 2008.

9. Once a paradigm is in place it is very hard to turn it around.

A lot of debt was shed after 2008. And then interest rates plunged. Household debt payments as a percentage of income are now at the lowest levels in 35 years.

But the response to 2008, necessary as it may have been, perpetuated some of the trends that got us here.

Quantitative easing both prevented economic collapse and boosted asset prices, a boon for those who owned them – mostly rich people.

The Fed backstopped corporate debt in 2008. That helped those who owned their debt – mostly rich people.

Tax cuts over the last 20 years have predominantly gone to those with higher incomes. People with higher incomes send their kids to the best colleges. Those kids can go on to earn higher incomes and invest in corporate debt that will be backstopped by the Fed, own stocks that will be supported by various government policies, and so on. Economist Bhashkar Mazumder has shown that incomes among brothers are more correlated than height or weight. If you are rich and tall, your brother is more likely to also be rich than he is tall.

None of these things are problems in and of themselves, which is why they stay in place.

But they’re symptomatic of the bigger thing that’s happened since the early 1980s: The economy works better for some people than others. Success isn’t as meritocratic as it used to be and, when success is granted, is rewarded with higher gains than in previous eras.

You don’t have to think that’s morally right or wrong.

And, again, in this story it doesn’t matter why it happened.

It just matters that it did happen, and it caused the economy to shift away from people’s expectations that were set after the war: That there’s a broad middle class without systematic inequality, where your neighbors next door and a few miles down the road live a life that’s pretty similar to yours.

Part of the reason these expectations have stuck around for 35 years after they shifted away from reality is because they felt so good for so many people when they were valid. Something that good – or at least the impression that it was that good – isn’t easy to let go of.

So people haven’t let go of it. They want it back.

10. The Tea Party, Occupy Wall Street, Brexit, and the rise of Donald Trump each represents a group shouting, “Stop the ride, I want off.”

The details of their shouting are different, but they’re all shouting – at least in part – because stuff isn’t working for them within the context of the post-war expectation that stuff should work roughly the same for roughly everyone.

You can scoff at linking the rise of Trump to income inequality alone. And you should. These things are always layers of complexity deep. But it’s a key part of what drives people to think, “I don’t live in the world I expected. That pisses me off. So screw this. And screw you! I’m going to fight for something totally different, because this – whatever it is – isn’t working.”

Take that mentality and raise it to the power of Facebook, Instagram, and cable news – where people are more keenly aware of how other people live than ever before. It’s gasoline on a flame. Benedict Evans says, “The more the Internet exposes people to new points of view, the angrier people get that different views exist.” That’s a big shift from the post-war economy where the range of economic opinions were smaller, both because the actual range of outcomes was lower and because it wasn’t as easy to see and learn what other people thought and how they lived.

I’m not pessimistic. Economics is the story of cycles. Things come, things go.

The unemployment rate is now the lowest it’s been in decades. Wages are now actually growing faster for low-income workers than the rich. College costs by and large stopped growing once grants are factored in. If everyone studied advances in healthcare, communication, transportation, and civil rights since the Glorious 1950s, my guess is most wouldn’t want to go back.

But a central theme of this story is that expectations move slower than reality on the ground. That was true when people clung to 1950s expectations as the economy changed over the next 35 years. And even if a middle-class boom began today, expectations that the odds are stacked against everyone but those at the top may stick around.

So the era of “This isn’t working” may stick around.

And the era of “We need something radically new, right now, whatever it is” may stick around.

Which, in a way, is part of what starts events that led to things like World War II, where this story began.

History is just one damn thing after another.