Student Loans: Averting a Generational Crisis

Student loans outstanding just passed $1.4 trillion. Starting next year one of the largest cohorts adding to that balance will have been born in the 2000s.

Let that sink in.

Collaborative Fund recently invested in NextGenVest, a company committed to helping Generation Z navigate the complexities of paying for college, particularly in areas where high schools lack adequate college advising and students are left confused and vulnerable.

We invested for two reasons:

-

The anchor student debt puts on young adults entering their careers could be a defining topic of the next several decades.

-

NextGenVest, led by Kelly Peeler, spreads the message to Gen Z both where they want to hear it and in language they can understand better than anyone we’ve come across.

We recently asked Kelly Peeler a few questions about the student loan problem.

Collaborative Fund: We expect 18 year olds with little to no financial education to sign their name on an amount of debt equal to a mortgage of someone in the middle of their career. It just seems crazy.

Yes, it is so crazy that Gen Z is essentially “buying their first house” at the age of 18 with little guidance, that I believe it is actually the beginning of the next financial crisis. After majoring in the History of Financial Crises in college, a few trends emerge over the past 250 years of crises. A lack of consumer protection is one of the key leading indicators to a financial crisis.

In the case of our users, who we meet in their junior or senior year of high school, all of the financial aid and student loan documentation is incredibly confusing, complex, and at times very misleading. We have students texting us at 10PM on a Sunday saying things like “wait, I thought this college gave me $20,000 in scholarships, you mean it’s actually a loan?” or “I don’t even know how much I owe or the interest rates because it wasn’t on the form I signed.”

More jargon and complexity triggers two behavior patterns - procrastination and shame. Both aren’t helpful in making positive financial choices.

You spend a lot of time with Gen Zs. What’s the biggest misconception about how they think about money?

The first is that they don’t care about their financial lives. The second is that they’re not actually making financial decisions themselves.

Many adults roll their eyes at an 18 year spending two hours a day on snapchat taking selfies. What we are seeing is that those same 18 year olds might actually be snapping about how stressed they are that their dream college didn’t award them any scholarships or that they don’t have any money to buy books. These of course don’t make up all the selfie snaps, but my point is we’re in the privileged position of seeing the anxiety, loneliness, and sometimes desperation that students feel around student loan burdens. They know and they are worried. They just don’t tell everyone. We are lucky they trust us with their concerns.

The second misconception is that parents are doing all the work. This might be the case for middle to higher income students, but for underserved low-to-middle income students this is just not the case. Our core user is a first generation college student who likely has non-english speaking parents, is fighting for the attention of a college counselor against on average 500 other students, and doesn’t have consistent access to a computer. This student is literally filling out student loan paperwork themselves, usually at night on the weekends, or in other words, when there is no one else around.

Turning that question around: What is Gen Z’s biggest misconception about money?

That the financial system, specifically college financing, is currently trustworthy and functioning in their best interest. It is not. This is why we’re starting to see the CFPB issue massive fraud charges against financial institutions and student loan servicers. We’re aiming to bring transparency to the thousands of decisions that surround this decision making process.

You’re queen for a day. You can remake the college financial aid system any way you want. What would you do?

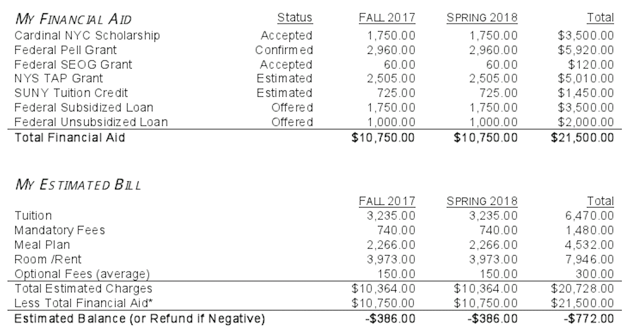

Make financial aid award letters from colleges standardized. A student will get into 5 to 7 colleges and they will get different “award” letters from each. Each one will be a different format, color, and categorize key things like loans in different buckets. Below is an example letter that one of our users sent us. Can you spot why this is misleading?

I’ll save you the 20 minutes it would take to read this thing. It’s misleading because “Federal Subsidized and Federal Unsubsidized Loans” are being counted as “aid” and subtracted from the total cost to attend for only 1 year (not the average 4). Good luck picking the best financial package at 18 years old when you also don’t happen to understand interest rates…which conveniently are not mentioned on this “award letter” either.

Your mission isn’t just about helping students avoid debt. Can you talk about some of the broader social problems that could come from letting this problem continue to grow at its current pace?

Gen Z will be the most indebted generation ever with the price of higher education increasing 1,000% over the past 30 years and the average student owing $37,000 in debt after graduating college. This is a monumental shift in the core financial identity of the 68 million people that will make up Gen Z. It will be the core factor in driving literally every future financial decision including things like where you work, where you live, how many children you have, and when you plan to retire (if at all). When we engage with our users we think about their long-term financial health and choices.

Two immediate ways this is informing societal problems are the following:

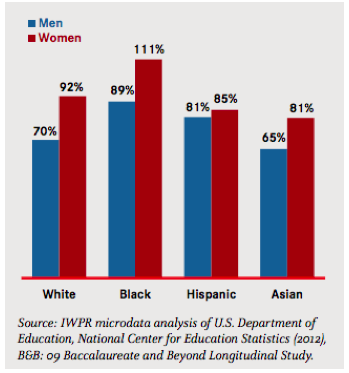

1. The modern day wage gap will become the debt gap. Across every race, female college students have a higher debt to income ratios which will only make gender equality worse.

Average Debt 1 Year after Graduation as a % of Annual Earned Income, by Gender and Race/Ethnicity

2. Socioeconomic divides will only increase. 30% of college students who take out loans end up dropping out of college. These tend to be students who are low to middle income or first generation college students. This means they both owe money and don’t have the employability prospects that come with a college degree, which keeps them in a vicious cycle of not only potential unemployment but also shame and lack of hope.

NextGenVest and Kelly Peeler were recently profiled in FastCompany.