Old World, New World

Here’s an iron rule of economics:

Growth = (change in number of people) + (people getting better at doing stuff)

They should tattoo this on your arm in Econ 101, because everything else you learn about how the economy grows is rooted in that equation. You can grow an economy by increasing the number of workers, or improving how productive those workers are, or some combination of the two. “Everything else is cream cheese” as they say.

People spend lots of time talking about getting better at things, because it’s exciting, and not a lot of time on the number of people we have, because it’s boring and almost always goes in one direction – up.

But that’s changing

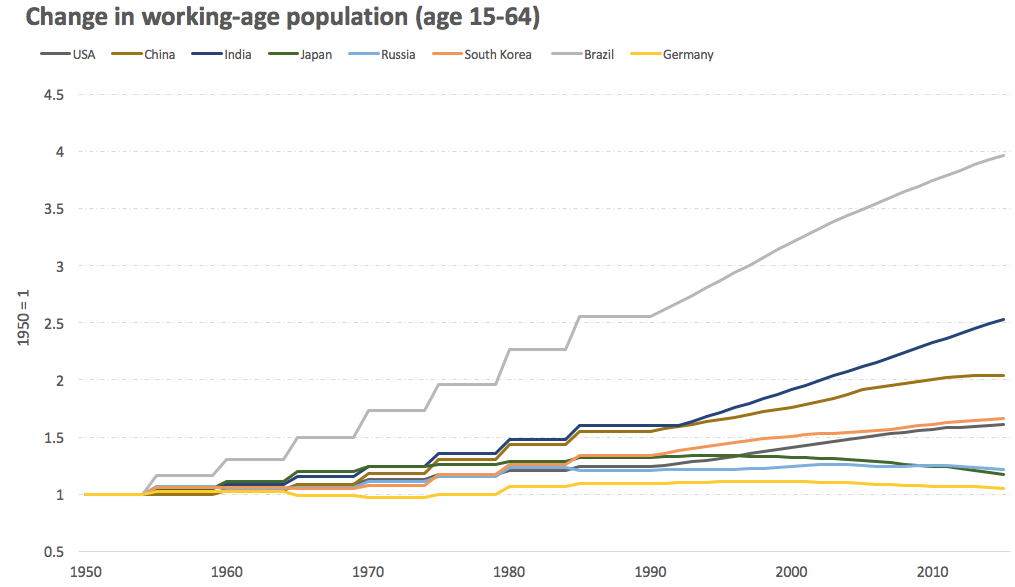

Here’s the change in working-age population from 1950 to 2015. It’s rising pretty much everywhere. (This data, from the Census Bureau International Database, is intermittent before 1990, hence the choppiness):

This was the old world. For decades, big countries could rely on there being more workers than there were the year before. More workers needed more homes, more cars, more insurance, more stuff. They meant more demand, which fueled growth before we even start talking about technology advances.

But things changed.

A hallmark of getting richer is your propensity to have fewer kids. The good news is virtually everyone got richer over the last 50 years, so families got smaller, almost everywhere. This began decades ago, as the worldwide baby boom that began after World War II peaked and fizzled. Italy, for example, saw its fertility rate fall from 3.5 babies per woman in 1954 to 1.4 in 2015.

Demographics are the silent stalker on economies because they move so slowly that they’re easy to ignore. We’ve known the birth rate has been falling for decades, but it hasn’t been a big deal for decades because the hypothetical kids who would have been born if the birth rate hadn’t declined still would have just been kids – not workers – without much impact on the economy. There’s a multi-decade lag between demographic trends beginning and those trends having an impact on the economy.

But it’s starting to now, because the falling birth rate that began decades ago is now baked into today’s working-age (age 15-64) population.

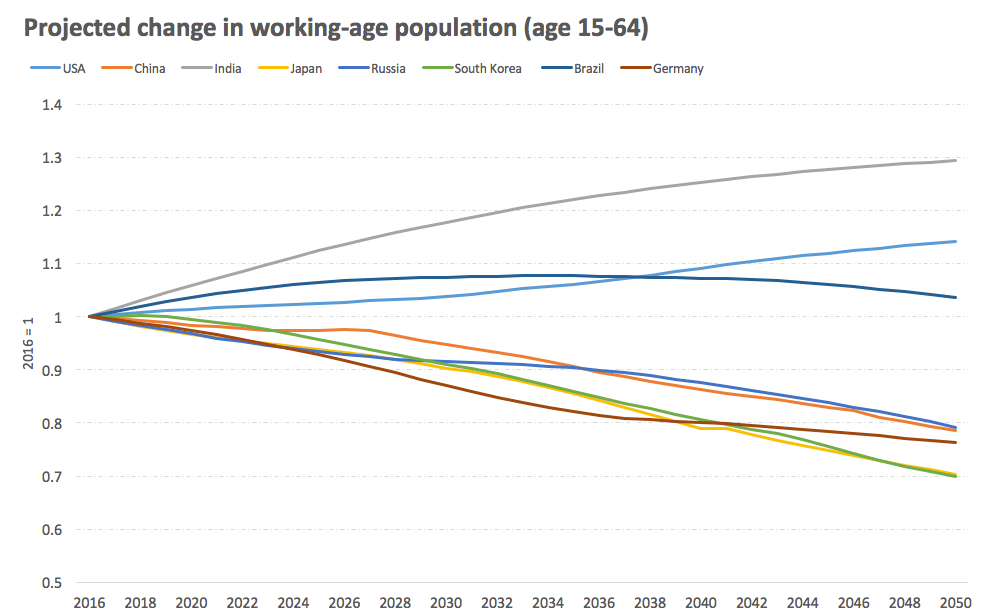

Here’s the projected change in working-age population from 2016-2050. It’s a totally different story than the first chart:

This is the new world. It’s one where a lot of the world’s powerhouses can no longer rely on there being more workers than there were the year before (Except, thankfully enough, America, whose working-age population continues to grow slowly). Japan, Russia, China, South Korea, Germany, Italy, France, and other big economies will likely see their working-age populations decline significantly for the next four decades. What had been a steady fuel for growth becomes a headwind.

Think about it in raw numbers. China’s Working-age population rose by 290 million from 1990-2015. It’s now set to decline by 214 million from 2015-2050.

I have a hard time seeing how this won’t be one of the biggest economic stories of the next half-century.

These are long-range forecasts, the historic accuracy of which no one is proud of. Europe is experiencing a refugee surge and the U.S. is talking about building a wall. Both occurred before these forecasts were made. And no demographer in, say, 1935 predicted the baby boom that began a decade later.

But so many things change if these trends play out even half as much as predicted. Workers might find newfound demand as companies face labor shortages. Retirement funding will come under increasing pressure. Industries with the most potential might shift from those targeting families to those targeting retirees.

The biggest change I think about the most is simple: We just need to change our expectations.

If you anchor to the old world where developed economies grow 3%-5% after after inflation, you’re going to be disappointed. An economy growing 4% a year when its population is booming is incomparable to an economy growing at 4% with a shrinking workforce. They are completely different things.

The good news is that, with slowing population growth, we don’t need the economy to grow as much as it did in the past for growth per-person – which is what really matters – to stay on track. The eminent econ blog Calculated Risk put it this way: “Right now, due to demographics, 2% growth is the new 4%.” Headline growth looks lower, but per-person growth won’t necessarily be.

In the past GDP growth was driven by an equal combination of more people and those people getting better at stuff. In the future it’ll overwhelmingly rely on getting better at stuff without much help from the “more people” side.

“The trick is growing up without growing old,” said Casey Stengel. Same thing here.