Reask: Predicting Extreme Weather In Uncertain Times

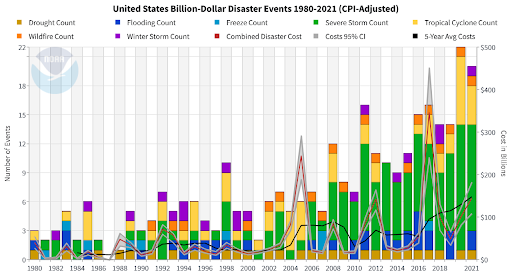

Extreme weather events are more frequent and severe than ever before.

Climate-driven weather events caused $115B in insured financial losses globally in 2022 — an astonishing 42% higher than the prior 10-year average.

The uncertainty caused by a surge of climate perils — hurricanes, cyclones, flooding, wildfire, and drought — presents a significant problem: if insurers, corporations, and governments can’t forecast damaging climate-related threats, they can’t make sound decisions to protect their assets.

This is a major problem – and opportunity – for the financial services industry and insurance markets, and the clients they serve.

Existing solutions for climate risk prediction exist, such as Moody’ RMS, but most are reliant on historical data. These models extrapolate from “historical loss rates” — the total value of losses over a given period divided by the total amount of exposure during the same period — to attempt to predict the future. But climate change is altering the frequency and intensity of weather events in ways that make historical extrapolation insufficient.

The models that predict future climate change are based on a range of assumptions and uncertainties, and it is difficult to accurately capture all of the complex interactions between the atmosphere, oceans, and land surface.

That’s where Reask comes in.

Led by Thomas Loridan and Jamie Rodney, along with a team of pioneering mathematicians, meteorologists and computer scientists, Reask steers clear of historical loss rate extrapolation in favor of bottoms-up physical weather modeling — the use of mathematical models to predict the weather based on current conditions and physical laws. These models take various atmospheric parameters such as temperature, humidity, wind speed and direction, atmospheric pressure, and others as inputs and apply the principles of physics to simulate the evolution of the weather over time.

Reask’s secret sauce is a set of proprietary weather models leveraging AI simulations that assigns risk factors down to the square kilometer.

This approach has several benefits:

Precision: Reask directly calculates highly accurate variables such as wind speed, and captures the full distribution of risk, moving beyond simplistic risk scores and instead allows clients to arrive at a price.

Clarity: Reask always uses physical variables to assess risk. Any output created can be directly related back to known physics of atmospheric systems rather than pure statistics.

Global: The Reask model is inherently global, capturing the physics of the climate, and allows clients a means to assess how climate risk can be diversified and managed within a portfolio of financial assets for the first time ever.

Reask’s APIs can be leveraged to empower traditional insurance and re-insurance companies such as Swiss Re, as well as a new era of climate-focused insurers such as Kettle, and Arbol to underwrite risk more effectively. The data can also be used by firms like Descartes to develop parametric insurance products that allow speedy relief to those impacted by damaging weather events.

Moreover, the specificity of the models and the global nature of Reask’s predictive capabilities enable a broader set of financial institutions and large asset holders to understand the risk their entire portfolio faces so that they can protect themselves, their employees, and the broader economy against impending catastrophes.

As we approach hurricane season in the United States, we’re excited to see Reask’s solution made available, and we’re thrilled to support Reask, as we co-lead their Seed round with our friends at Mastry Ventures.

You can follow the company’s progress here.

And, if you’re working on ways to combat climate change, we’d like to hear from you!