The Dam Breaks Toward Doing Good

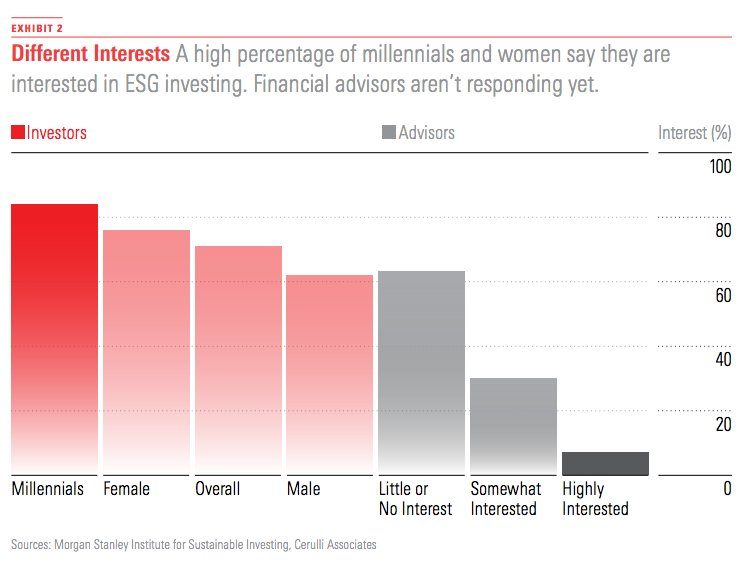

This chart, from Morningstar, tells an amazing story:

Demand for investments that aspire to do more than maximize profits – or, use that mission as a competitive edge to maximize profits – far exceeds the supply of opportunities.

Startups are trying to fill the void. A ton of new fund companies, investment platforms, and advisors are basing their value in socially responsible investments.

But big change doesn’t happen until the deep pockets move. It’s hard to blaze a trail when you’re a decades-old, high-profile firm, run by people naturally scared of upending norms. But once a few big firms move, the dam breaks and others find it easier to follow.

And, good news, the dam is breaking:

The Ford Foundation has committed $1 billion to mission-related investments.

Japan’s Government Investment Fund recently allocated 1 trillion yen ($8.9 billion) to socially responsible investments.

Morningstar acquired 40% of Sustainalytics, a provider of ESG research and ratings.

Swiss Re is moving its entire portfolio to track ESG-related investments.

Betterment and Wealthfront are offering socially responsible portfolios.

Bain Capital and TPG launched an impact fund.

Ritholtz Wealth Management launched an ESG portfolio.

The Department of Labor has cleared the way to allow ESG-related investments in retirement plans under fiduciary guidelines.

The U.S. Impact Investing Alliance now includes the head of Merrill Lynch Wealth Management.

Every one of these groups has a high enough profile to entice others to follow.

This is the biggest and most important investing trend we know of, and it’s not slowing down. Tadas Viskanta recently wrote: “At some point in the future, what we call ESG investing today will simply be called ‘investing.’”