The Shallow Benefit of Deep Liquidity

At some point in the last few years high-frequency traders began using picoseconds to measure the time needed to execute their trades. That’s a trillionth of a second. Big numbers require context: There are as many picoseconds in one second as there are seconds in 31,709 years.

Few things can be done faster than the time it takes to buy or sell hundreds of companies’ stock. It can be done in huge amounts, too. Bill Gates has sold $200 million or more worth of Microsoft shares almost every month for a decade.

The term for this is liquidity. Most individual investors can turn their stock portfolio into cash at reasonable prices in seconds. Institutions can usually do it in days or weeks.

It is a massive benefit to investing in public stocks. But it doesn’t come free. You pay a lot for the service. And it’s a service many public investors overpay for, unaware of its downside.

Here’s the problem. The more liquid an investment is, the lower return it will earn compared to similar investments that are less liquid. The upside is that you can sell a liquid investment in the next few picoseconds. But most financial advisors praise liquid investments while (rightly) preaching long-term investing where you don’t touch your investments for years or decades. It’s hard to square the two.

Ask yourself: If Vanguard offered an S&P 500 index fund with a five-year lockup that guaranteed an extra percentage point of annual returns above the fully liquid fund, would you take it? I would. Many of you would.

These aren’t small numbers. The liquidity premium – the amount of return you surrender for the benefit of being able to sell quickly – can be bigger than most of the edges public market investors fight over. UBS found that each month a hedge fund bars its investors from redemption translates into an extra 20 basis points of return, on average. Another study of illiquid private equity funds showed roughly the same premium over comparable S&P 500 stocks. Two percentage points a year is astronomical in a world where investors bicker over basis points. It is several times larger than the beaten-into-our-brains impact mutual fund fees have on returns.

Most of my investments are liquid. It has advantages even for long-term investors, like the ability to buy a little more each month. This is not black or white, and the liquidity offered in public markets is a net advantage for most investors. But after working with private investments – which are mostly illiquid, and backed by investors in funds with 10-year lockups – I’m amazed at the benefits that come from parting with liquidity, and how little attention public market investors pay to the topic.

Giving up some liquidity not only offers additional returns; it guards against investors’ temptation to misbehave, which is the single biggest problem in public markets.

The stock market is one arena where people play different games.

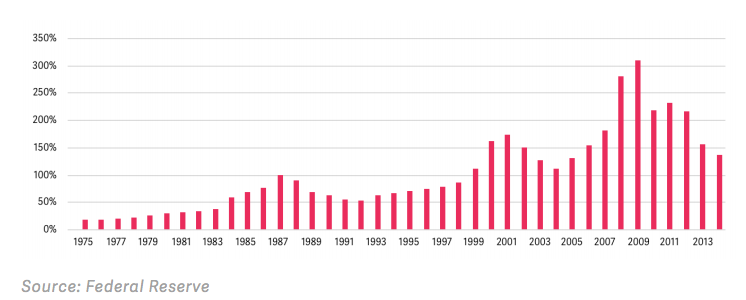

One game is trading. Traders pass shares back and forth between each other. They exchange shares so often that our public markets have deep liquidity, with a willing and able buyer or seller virtually always available for thousands of companies. This has grown over time; there’s multiple times more liquidity today than a few decades ago:

Stock Value Traded as a Percentage of Market Capitalization

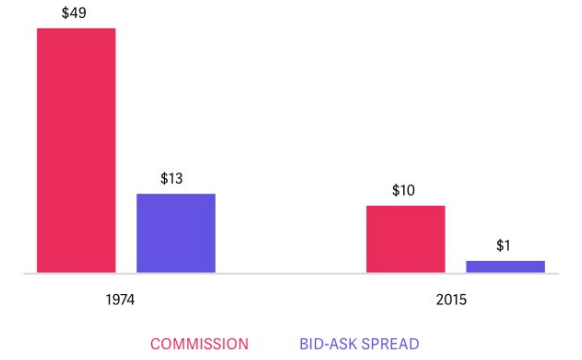

And the cost of trading has come way down:

Another game is investing. It’s a game of waiting, where trading is only needed to enter or exit the game, like a door to the field. After they’re on the field, investors don’t do much. Effectively all of the net inflows into public markets over the last decade have gone into index funds, and many index fund investors, particularly those saving for retirement, sit patiently. The S&P 500 fell almost 20% in August 2011. Trading volume hit record highs. But the average Vanguard investor responded by doing nothing at all. 98% of Vanguard 401(k) investors didn’t make a single change to their portfolio. In October 2008, the peak of the financial crisis, 96% didn’t touch their accounts. A ton of investors dollar cost average through their 401(k) and never look back.

The point is there’s a difference between those providing market liquidity and those in need of market liquidity. People play different games with different needs, so what’s good for one game might not help another. Traders are much better off today than they were 40 years ago. Are investors? I’m not sure.

When two groups of investors are playing different games on the same field, it’s easy for one to mistakenly take cues from the other. That’s how bubbles form. In this case, investors with years in front of them may be wrongly persuaded to transact when their emotions are triggered by the ups and downs caused by traders, who are playing a different game with different objectives. This problem is going into overdrive now, because public markets are barbelling into two groups: Hyper-fast computer traders, and buy-and-hold index investors. This is prime soup for investors to be tempted to misbehave. Investors – particularly those outside the restraints of a 401(k) – are basically trying to diet while traders throw Snickers at them. Michael Batnick often points out the few investors earn the returns of the top-performing stocks, because volatility scares them out. And liquidity lets them out.

Solving for poor investment behavior is the hardest problem in investing. The smartest financial advisors I know devote their life attempting to get investors to behave better. But it’s hard. Poor investment behavior – fear and greed – are driven by hormones that override reason.

The only strategy I know of that truly helps everyone with poor investment behavior is taking liquidity away as an option. It’s a world I’ve seen up close in my last year working with private market investments that have little liquidity.

What do we do when we read a scary headline about a looming recession? Nothing. Because we can’t.

What do we do when one of our portfolio companies misses its quarterly numbers? We try to help them, but we don’t sell. Because we can’t.

How do we respond when one of our portfolio companies is crushing it? With a high five, but not much else. Because there’s not much else we can do.

Which is awesome.

We are forced to think like long-term investors, barred from the option, let alone temptation, of trading. So are the backers who invest in our funds. We’re bound to hold our investments until an outside source of liquidity comes along – maybe an IPO, maybe an acquisition, maybe another private buyer in the secondary market. That might take years. But we have years. And so do most public market investors, despite playing in an arena filled with the return reductions and poor-behavior temptations of constant liquidity.

Nothing’s perfect. There are downsides to not having much liquidity, particularly the inability to get into investments when you want to – you can’t be a buy-and-hold investor if you can’t buy. Private markets – private equity, VC, hedge funds, – as they’re structured now aren’t right for the vast majority of individual investors. They may never be.

But I wonder if public markets could be improved to better serve long-term investors who don’t require the liquidity of a trader.

Three things stick out.

Could more mutual or index funds charge redemption penalties on investors who cash out before holding for a certain period of time? A few funds do this, but not many. More of it would solve a small but real problem of long-term fund managers having their investment decisions dictated by the whims of inflows and outflows.

Another is the tax code. I’ve always been in favor of a tiered capital gains tax that scales down at longer holding periods, beyond the current two-rate system. We’d entice more true investing by, for example, taxing any investment held less than a month at 50%, and anything held for more than 10 years at 10%.

A bigger change is what Eric Ries and his team are building at Long-Term Stock Exchange. An entire new stock exchange with sticks and carrots to incentivize both companies and their shareholders to focus on the long run, it has the potential to segregate true investors from traders playing a different game.

A few years ago I interviewed an NYSE trader. She talked about the glory of how liquid our markets have become in the last few decades. Later that day I interviewed a mutual fund manager. He talked about how much worse the problem of short-termism has become in the last few decades.

Both are right. They’re just playing different games. We’d solve so many problems by realizing the difference and sticking to our own courts.