Warren Buffett Was Always a Brand Guy

A few weeks ago, I came across a letter Warren Buffett wrote in 1972 to Chuck Huggins, then president of See’s Candy. It’s two pages long, typed on letterhead, and quietly brilliant.

Reading it now, more than fifty years later, it feels less like an internal memo and more like a manifesto about what makes a brand endure.

“People are going to be affected not only by how our candy tastes,” Buffett wrote, “but by what they hear about it from others as well as the retailing environment in which it appears.”

In those lines, you can see how Buffett was already thinking far beyond unit economics or margins. He understood that the true value of See’s wasn’t measured by its ingredients or its quarterly earnings. It was in the feeling the brand produced - the trust, nostalgia, and quiet pride that came with handing someone a white and gold box tied in ribbon.

He was describing brand equity before that term was widely used.

The Hidden Value Not Found on a Balance Sheet

Buffett often talks about moats; the durable competitive advantages that protect a company over decades. In See’s Candy, he found one that was remarkably intangible: customer love.

It’s easy to think of Buffett as the world’s most disciplined value investor. But letters like this reveal something deeper. He has always been a brand investor, someone who recognizes that the strongest companies don’t just sell products; they sell belief. They create environments and stories that compound over time.

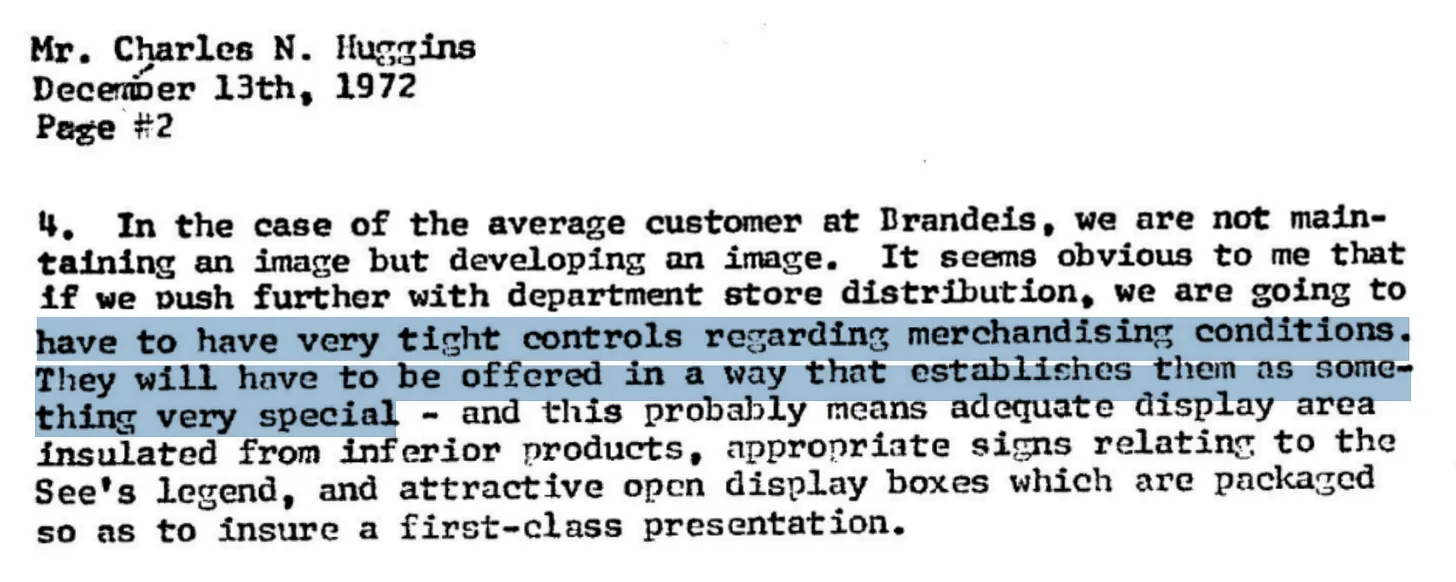

“If we push further with department store distribution,” he cautioned, “we are going to have to have very tight controls regarding merchandising conditions. They will have to be offered in a way that establishes them as something very special.”

He knew that brand perception couldn’t be outsourced. Every display, every piece of packaging, every interaction mattered. That resonates deeply with how we try to invest at Collaborative Fund. The moat we care most about is emotional, not transactional.

See’s Candy and the Collaborative Lens

We often say that great brands “scratch an itch” — they solve a deep, recurring need that people actually feel. In 2013, I wrote a short post by that name, arguing that the best companies are the ones that clearly answer two questions:

- What is this person’s itch?

- How can we align our interests by scratching it?

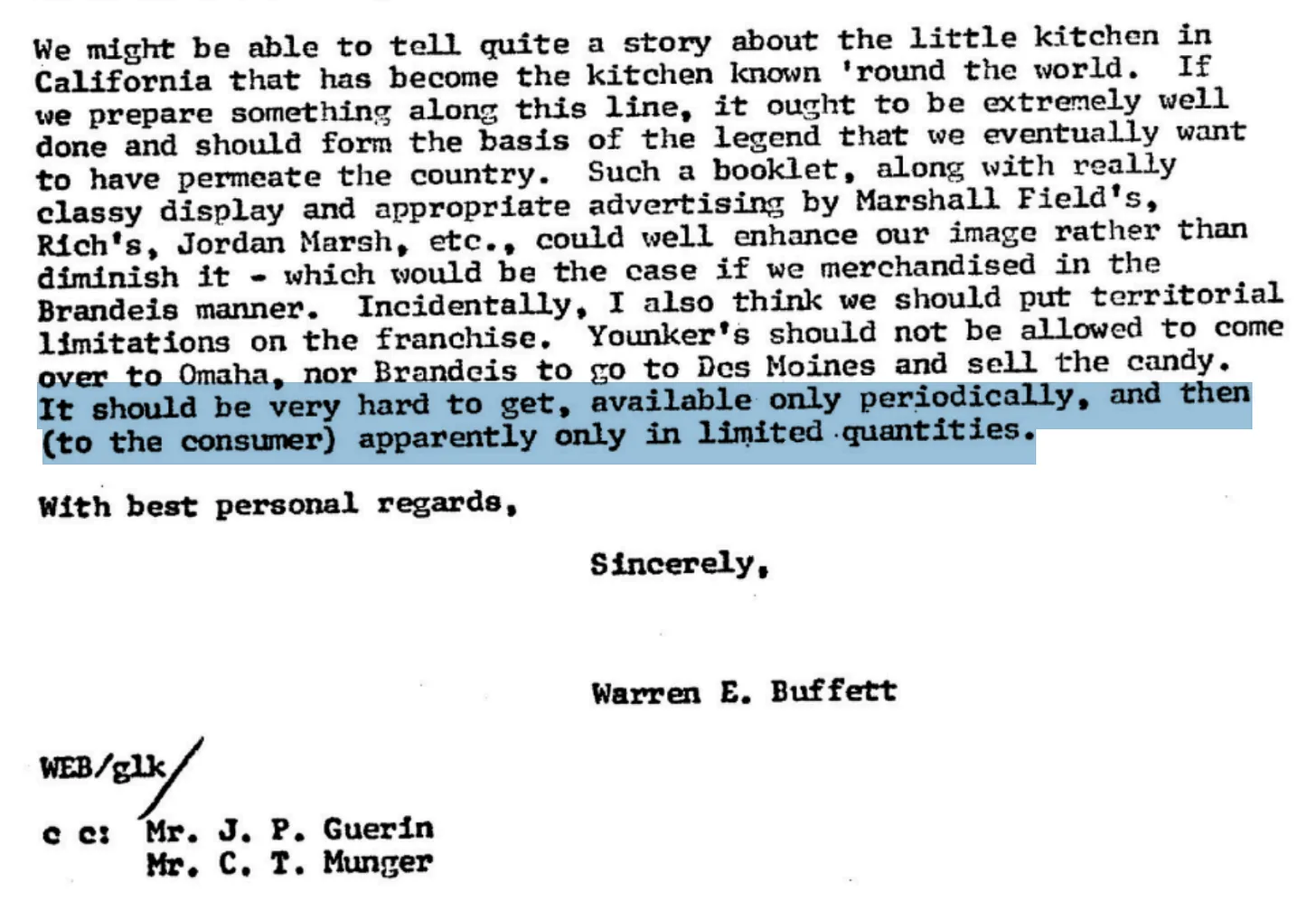

Buffett, a decade before many modern brand marketers were born, intuited this perfectly. He knew that See’s scratched a very specific societal itch — not hunger, but something closer to affection: the ritual of gifting, the small gesture that says I thought of you.

That’s the kind of intangible value that compounds quietly for decades. You can’t model it in Excel, and you won’t find it in a discounted cash flow. But you can feel it in the way people talk about the brand, and the way they keep returning to it year after year.

The Brand Guy in the Value Investor

Buffett has always described his preferred business as one that “can raise prices without losing customers.” What he really means is one that has earned the right to be loved and trusted.

See’s Candy could do that because it felt rare, careful, and human. Everything around it reinforced that perception. Buffett even wrote that it “should be very hard to get, available only periodically, and then apparently only in limited quantities.”

He was thinking like a cultural anthropologist, not just an investor. He understood the psychology of desire.

That’s what we look for at Collab — companies with purpose and empathy baked into their DNA, where the brand’s story and product experience are inseparable. Companies that, like See’s, pass what we call the Villain Test: if they disappeared tomorrow, who would be genuinely sad?

What Endures

Buffett bought See’s for $25 million. Since then, it has produced billions in profit for Berkshire Hathaway and an immeasurable amount of goodwill for customers who still associate those signature boxes with care, quality, and connection.

Half a century later, the letter reads like an early draft of the Collaborative investment philosophy. He wasn’t talking about candy at all, really. He was talking about trust, consistency, delight — all those overlooked forces that turn a product into a brand and a brand into a legend.

That’s still the itch we’re trying to scratch.