What Can We Do About Water?

It’s about time we dive into the wicked challenges surrounding water, why now things might be different, and where the venture community should pay closer attention.

Water scarcity and quality issues are often invisible to those who have never faced them.

However, having lived in Mexico City and with family in the American Southwest, I have witnessed the profound impact of water scarcity — from small businesses grappling with usage limits in Mexico City’s bustling Colonia Condesa to plummeting property values in New Mexico where wells have dried up.

In the next decade, we anticipate significant shifts: businesses will be held accountable for excessive water usage, families will opt for higher-quality water solutions, and technology will be crucial in reducing wastage.

Let’s start with the basics

Water is heavy, corrosive, costly to transport, evaporates easily, and is often not used where it is most abundant. Below are a few key facts and figures that grounded our research:

- The world’s water supply is 332.5 million cubic miles (96% of it is salt water)

- Agricultural consumes 70% of global freshwater supply, industry (20%), individuals (10%)

- Water leakage from inefficient and aging infrastructure causes water loss of 15-60%

- 40% of the global population lives in water-stressed areas

The macro landscape today

We have reached an inflection point defined by political will, corporate intervention, consumer awareness, new technologies, and early activity in M&A and public markets.

-

AI is greedy for energy and water: The US data center footprint is expected to absorb 35 gigawatts of electricity by 2030, more than twice the total demand in 2022—growing compute is draining not only electricity but also water.

-

Water infrastructure is the next electricity grid: Upgrading contaminated water pipes had the highest bipartisan approval rating (87%) surrounding the $22B from Bipartisan Infrastructure Law. The landmark infrastructure bill expands access to clean drinking water, replaces lead pipes, improves wastewater and sanitation infrastructure, and removes PFAS contamination in water. This is a drop in the bucket and will need to be augmented by private capital.

-

Consumers are waking up: Incidents in places like Flint and Jerusalem remind us that water quality cannot be taken for granted. Consumer-facing filters help, but often fall short of removing all contaminants, underlining the need for more comprehensive solutions. There is room for large consumer businesses to educate and address this at the light household infrastructure level.

-

Major corporations on the move: Corporate commitments set targets while identifying customers for breakthrough startups. Common targets include improving operational efficiency while being better watershed stewards. For example, Coca-Cola has committed to achieving 100% circular water use across 175 facilities.

-

Increased M&A activity: The last 16+ months have seen an uptick in M&A activity from corporates, largely focused on improving water intelligence. For example, EMEA based insurer Swiss RE acquired Fathom to improve their flood risk intelligence.

“When the well is dry, we know the worth of water.” — Ben Franklin

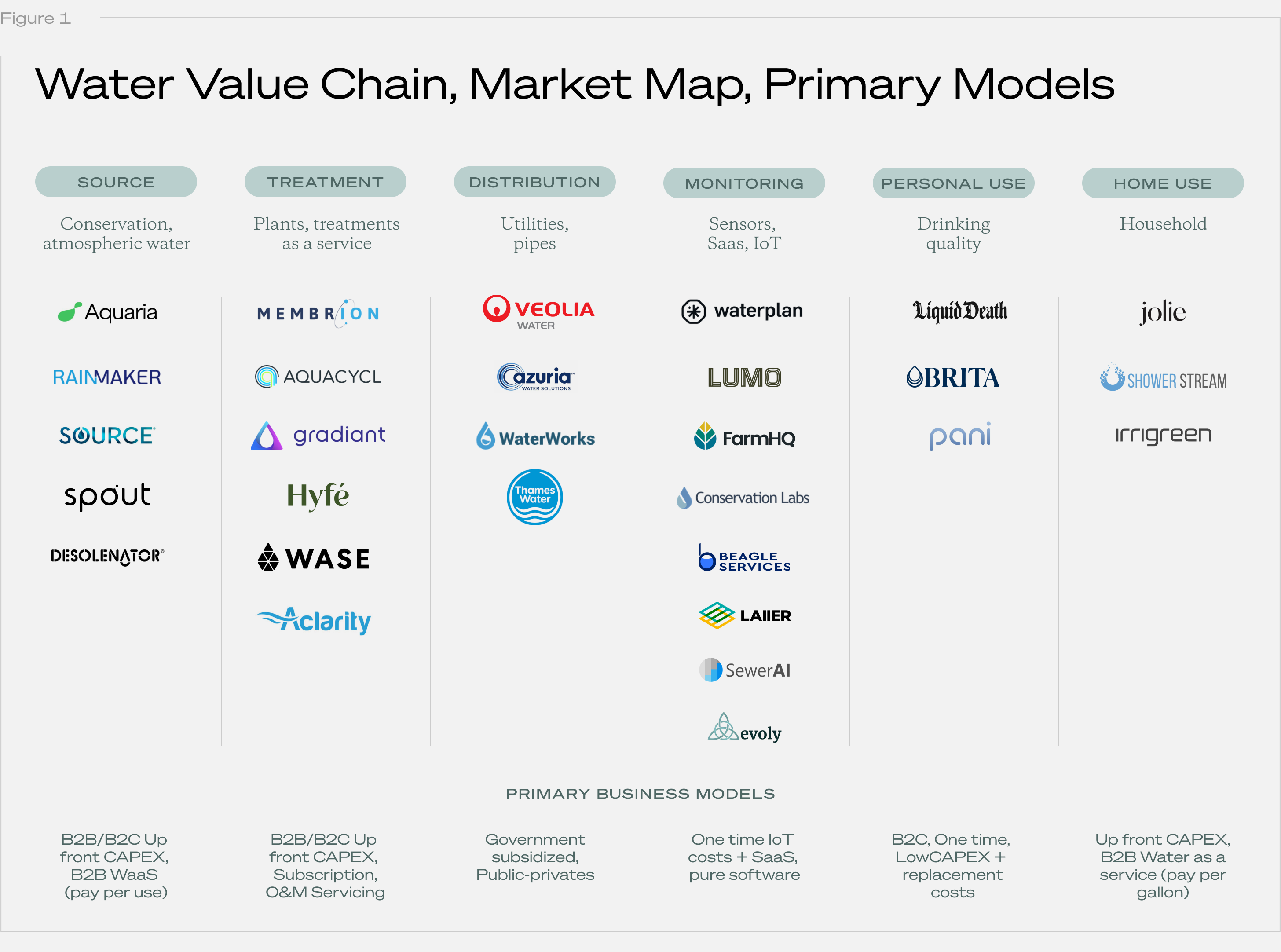

The value chain and its opportunity zones

Ten years ago, the water value chain — from source and treatment to distribution — were reserved for major CAPEX project developers in partnership with state governments. Today, each aspect of the water value chain welcomes a new generation of venture backed players.

1. Monitoring technology has seen the most activity

Problems like remote shutoff, leak detection, and usage management are a consistent thorn in the side of major agriculture and real estate customers. Insights from IoT devices and operator facing SaaS tools are resulting in more visibility, time savings, and risk mitigation for enterprise customers (FarmHQ, LUMO). AI enabled platforms (LAIIER, SewerAI) are taking that service to the next level with predictive demand and maintenance analytics. At the corporate level, platforms like Waterplan enable executives to manage global supply chains facing increasing scarcity risks.

2. Renewed venture interest in water treatment companies

Why? Increased regulatory concerns surrounding PFAS have put corporate stewardship in the spotlight. End-to-end solutions like Gradiant, Aclarity, and Membrion offer a water treatment solution that reduces, reclaims, and renews water supply for industrial customers. Many of these solutions require upfront customer CAPEX, along with ongoing subscriptions and servicing arrangements which can be daunting for smaller businesses but fundamental for larger customers in the chemical, food, and manufacturing sectors. Hyfe is a pioneer in waste-to-value offerings transforming wastewater into feedstocks for offtakers.

3. Trends in water generation technology

Atmospheric generation membranes enable water to be drawn down from thin air based on precipitation, the open question for players like Aquaria is to master the volume production in arid regions. If you cannot produce at a useful volume when needed (or store it appropriately), customers either won’t build in certain regions or continue to need deep well infrastructure. SOURCE has coupled atmospheric generation with home heating and energy source applications, enabling higher degrees of circularity. Spout leverages the same core technology, but instead offers it as an elegant kitchen top water supply.

Unique systemic risks

Before racing ahead to build and invest in the companies looking to address these massive challenges, there are a few unique risks to keep top of mind.

-

Misaligned stakeholders: The question of who pays for the infrastructure, who maintains it, who uses the resource for what purpose at what quality and volume, ultimately who is responsible to ensure its ongoing purity are surfacing in blockbuster litigation across the nation. 3M´s existential case set to see trial in June 2024.

-

Price of water does not match its value: Unlike most commodities, there are currently no free market methods to set water prices according to supply, demand, and its value to end users. Morgan Stanley and other financial institutions have raised the issue of this discrepancy, asserting that it limits the number of bankable projects capable of supporting the federal commitments to improve water quality - forcing state and local governments to foot the bill. If water does not have a price that reasonably reflects its value, it not only limits the ROI for invested capital in new projects, but limits the servicing and care budgets available to private operators.

-

Permitting and NIMBYism: Critical water infrastructure has historically been slow to deploy at the scale and pace required. Much like the electricity grid, rulemaking and understaffed agencies contribute to the bottleneck resulting in high soft costs, slow time to market, and ample space for litigation and project disruption. In cases like Poseidon in Los Angeles, desalination projects battle for years in the courts before ultimately abandoning in the face of local activists.

Collab Fund’s perspective on the market today

As we think about investing in water, we are looking for transformational technologies at the seed stage, and scale-ready companies at later stages. At the seed, we ask - if this thing is successful, will it change the reality today as we know it? That might be a fundamental shift in how water is created, treated, or managed for households, corporations, and governments. Later on it’s about finding companies that are eager to get to market.

There is plenty of room for entrepreneurs to build category-defining companies in the water space. Technology has enabled new markets, and the problem of quality and use has reached a boiling point. If you are building in the space, please don’t hesitate to reach out. We are excited to meet you.