What We’re Reading

Here are a few good articles the Collaborative Fund team came across this week.

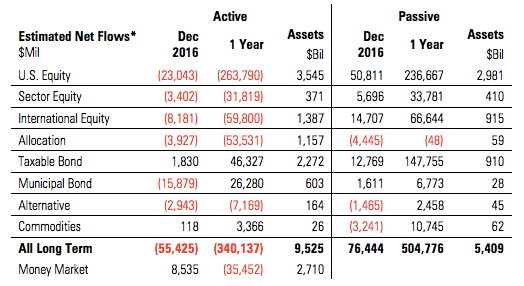

Flows

The amount of money moving out of active investing and into passive funds is truly staggering:

Competition

These stats on ride-hailing apps like Lyft and Uber’s impact on Yellow cabs in New York were not as bad as I assumed they’d be:

Over all, yellow cabs made an average of 336,737 daily trips and $4.98 million in fares in November, down from 463,701 trips and $5.17 million in fares in the same month in 2010, according to city data.

You can see where this is going

Pretty clear where the world is heading:

One of every five dollars invested in the US today targets sustainable investments. Not to be outdone, private capital is flowing there too. Bill Gates, Mark Zuckerberg, Jeff Bezos, Jack Ma and other tech titans recently committed $1 billion to launching a new, low carbon energy fund. Warren Buffett’s company is busy investing in new solar and wind energy projects, including the world’s largest solar plant. And 84 major corporations have pledged to source 100 per cent of their energy from renewables going forward.

Clarity

This is a great piece on communication:

Some of the most useful things I’ve learned about startups over the years are also things I’d never share publicly. Not because the ideas are necessarily controversial in their own right, but because anyone could twist them to seem controversial if they were sufficiently motivated to. And when that happens I immediately regret having said anything. It’s a massive distraction. I have two young kids, and I have hundreds of startups to keep track of. I don’t have time to fight with people who are trying to misunderstand me.

Bits of optimism

This is an important point in the fear of automation replacing jobs:

“This is going to take decades,” said James Manyika, a director of the institute and an author of the report. “How automation affects employment will not be decided simply by what is technically feasible, which is what technologists tend to focus on.

Good advice

I love this piece on what a lawyer has learned about investing:

One Size Doesn’t Fit All. When you shop for clothes or shoes, there are a variety of sizes and styles, because each of us is physically different and has an individual fashion sense (or lack thereof). Similarly, investing choices should be tailored to fit you as an individual. A conscientious and knowledgeable advisor will carefully evaluate you to determine which investments are appropriate and how much to invest in each … Run, don’t walk, from any advisor who tries to sell you something without first learning about you and your risk tolerance, or who has the same solution for everyone, or who recommends putting all your assets into a single type of investment.

Have a good weekend.