What We’re Reading

Here are a few good articles the Collaborative Fund team came across this week.

Rebound

Detroit is on an upswing:

Tech employment in Detroit is now at 78,510, a 40.7 percent increase from 2011. The non-tech sector only grew by 18.9 percent in that time …Detroit is more appealing now, and the Millennial population is growing. The city has seen a 9.2 percent increase in its 20-29-year-old population since 2010, ranking it sixth in millennial population growth in large U.S. cities, according to the study.

Brand

A good piece on Ritholtz Wealth Management:

When you consistently show who you are, what you’re interested in, what you care about, and what you stand for on a daily basis, you engender trust. You can certainly attempt to do that with an end goal in mind, but as Buffett says, “it takes 20 years to build a reputation and five minutes to ruin it.” For these guys at RWM, it is just routine, unwavering authenticity. Every day I receive their blogs in my inbox. Every morning I get Ritholtz’s Morning Reads from Bloomberg. Every Friday afternoon I get Barry’s latest podcast in my podcast app. It’s just routine at this point. I have made it a part of my daily and weekly agenda because I place such high value on Barry and team’s work. Often times it’s also entertaining and pretty funny.

Middlemen

Amazon is investing heavily in its own brands:

Amazon is selling products across a wide array of categories, using a host of brands that do not exist outside the confines of amazon.com and do not make it clear that they are Amazon-made products. Trawling through over 800 trademarks that Amazon has either been awarded or applied for through the US Patent and Trademark Office (USPTO), Quartz identified 19 brands that are owned by Amazon and sell products or have product pages on amazon.com.

Communication

The next billion internet users:

Instead of typing searches and emails, a wave of newcomers—“the next billion,” the tech industry calls them—is avoiding text, using voice activation and communicating with images. They are a swath of the world’s less-educated, online for the first time thanks to low-end smartphones, cheap data plans and intuitive apps that let them navigate despite poor literacy.

Complication

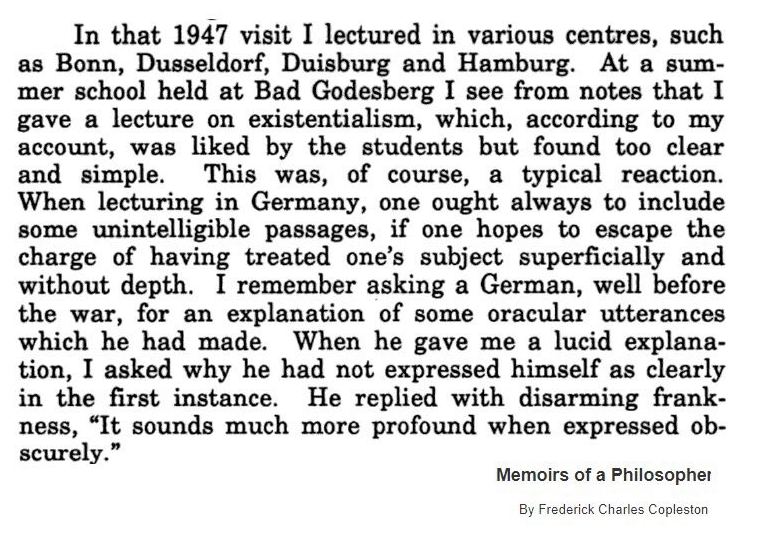

Same as it ever was:

Valuation

The practice is not as egregious as it sounds, but is still important to understanding venture-backed valuations:

About half of private companies with valuations exceeding $1 billion, known as unicorns, wouldn’t have earned the mythical title without the use of complex stock mechanics, according to a study by business professors at the University of British Columbia and Stanford University … One provision frequently afforded to investors is called a liquidation preference. It guarantees a minimum payout in the event of an acquisition or other exit. The study found that it can exaggerate a company’s valuation by as much as 94 percent. Researchers pointed to AppNexus, a digital advertising startup. The company sold shares with a liquidation preference that guaranteed new backers at least double the amount they put in if AppNexus is acquired.

Have a good weekend.