What We’re Reading

Here are a few good articles the Collaborative Fund team came across this week.

Brand

Walmart tries to increase its influence, finds it’s hard:

Wal-Mart hopes to leverage the popularity of these niche, trendy sites with subsets of consumers who wouldn’t be caught dead in a Wal-Mart store. And the kids are not having it. ModCloth and Bonobos are being cyberbullied by their fans online, who are making fun of the brands for what they see as selling out to the corporate machine.

“The thing I loved about Modcloth is that I knew the clothes I bought there couldn’t be found at Macy’s and weren’t worn by the masses,” said Connie Warner, who started a Boycott ModCloth page on Facebook. “No more. I’ve unsubscribed from their emails. I refuse to shop at a store owned by Walmart.”

Statistics

Reader beware:

When reading people like Mr. Gladwell, you’re probably thinking many of the studies’ conclusions sound right but don’t really reflect your own experience. That’s probably because you’re not a hung-over grad student. Andrew Ferguson of the Weekly Standard studied behavioral economic studies and discovered many are done by grad students observing their peers doing trivial tasks. Then researchers draw hard conclusions from this. Rather than a study of human nature, behavioral science is, Mr. Ferguson observes, “the study of college kids in psych labs.”

Endurance

A great post on the power of profitability:

[Startup] profitability doesn’t represent failure; rather, it is an unmovable milestone that captures so many values those outside of the world of startups hold dear- self reliance, independence, ownership, control …Owning your destiny. It’s an incredibly powerful concept anywhere else but in the world of startups.

Precision

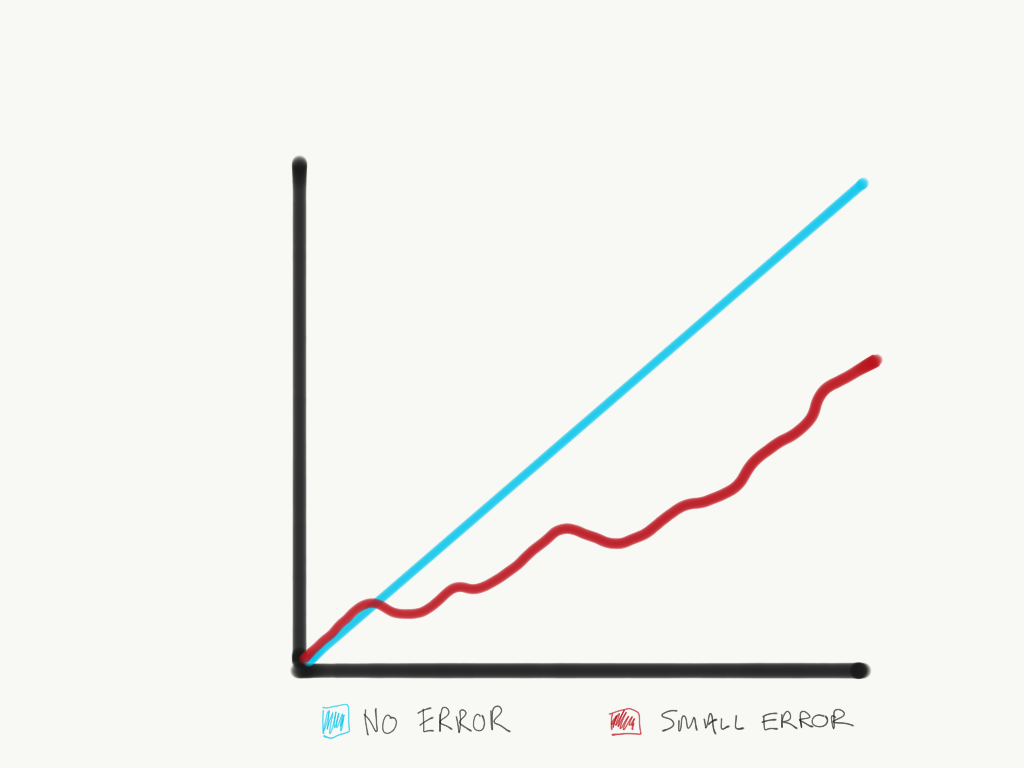

A very insightful post on the butterfly effect:

Growth

Lyft’s progress has been incredible:

Lyft’s share of the ride-hailing market has hit record levels in nearly 30 major U.S. cities in the past month, by dollars spent, according to new data. In the top 10 markets, Lyft’s highest share is 39.5% in San Francisco, and 33.5% in Los Angeles, according to Second Measure, which tracks credit card transactions.

Overall, Lyft has between 20% to 30% of the U.S. market, depending on who is counting, to Uber’s 70% to 80%. But the data show that Lyft has become a growing problem for Uber in some major cities, which could limit Uber’s ability to turn profitable. The U.S. is the world’s top market in terms of revenue per rider, and ride fares could reach more than $10 billion this year. Without profits in the U.S., Uber may not be able to continue investing in developing markets, such as India, Latin America and Southeast Asia.

Management

Hard to get around this:

“The reason [for why great companies failed] is that good management itself was the root cause. Managers played the game the way it’s supposed to be played. The very decision-making and resource allocation processes that are key to the success of established companies are the very processes that reject disruptive technologies: listening to customers; tracking competitors actions carefully; and investing resources to design and build higher-performance, higher-quality products that will yield greater profit. These are the reasons why great firms stumbled or failed when confronted with disruptive technology change.

Have a good weekend.