What We’re Reading

Here are a few great articles the Collaborative Fund team came across this week.

Mobile payments

This is amazing:

According to recent data, Ant Financial and Tencent were set to surpass credit card companies like Visa and Mastercard in total global transactions per day in the coming year.

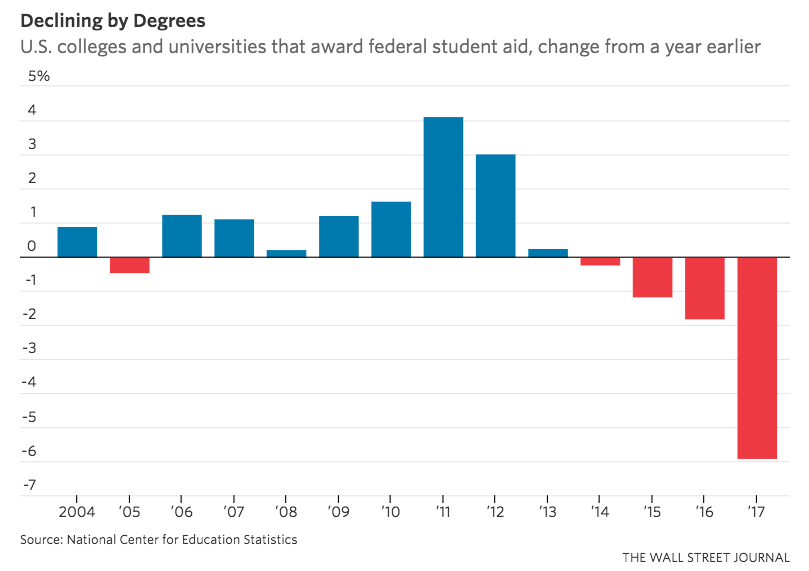

Supply

The number of colleges is plunging, driven by for-profit closures:

Expectations

Stripe’s culture guide is great:

The bad news: our success is far from being assured. Most companies that have ever gotten to Stripe’s stage have plateaued — or worse. We consider lots of things to be “broken” today — and the more successful we are, the faster things will come to break in the future. (If you’ve ever played a tower defense game… scaling a fast-growing startup feels a lot like that.)

Stocks for the long run

Took a while:

The S&P 500’s information-technology sector ended the day at 992.29, closing above its previous high of 988.49 set in March 2000 at the peak of the dot-com bubble. Tech stocks are by far the best performing among the index’s 11 sectors this year, up 23% after posting their ninth consecutive day of gains.

Careers

Great reflections after 20 years on the job:

Treat the job as if you are lucky to have it, because you are. There are many wonderful people with brilliant minds who will never get the opportunity to sit in your seat. Somehow, you’re sitting here. This is an amazingly fabulous opportunity. Do something with it, and don’t waste it.

Humility

How economics became a religion:

The hubris in economics came not from a moral failing among economists, but from a false conviction: the belief that theirs was a science. It neither is nor can be one, and has always operated more like a church. You just have to look at its history to realise that.

Have a good weekend.