What We’re Reading

A few good articles the Collab team came across this week …

Relationships

The loneliness health crisis:

When you look at the data, what’s really interesting is loneliness has been found to be associated with a reduction of life span. The reduction in life span [for loneliness] is similar to that caused by smoking 15 cigarettes a day, and it’s greater than the impact on life span of obesity. So if you think about how much we put into curbing tobacco use and obesity, compared to how much effort and resources we put into addressing loneliness, there’s no comparison.

Appreciation

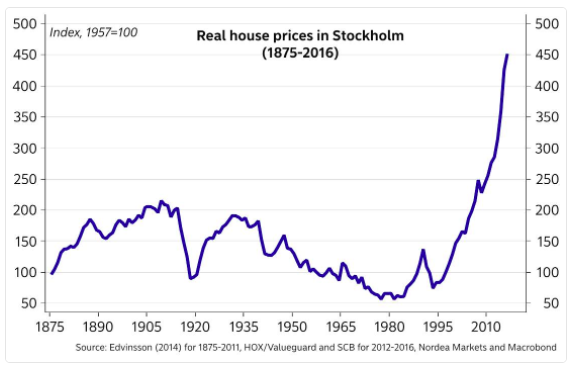

Real home prices in Sweden:

Management

This is great, and probably true sometimes:

Warren Buffett may have said “when a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact,” but that was clearly before he met Elon Musk. Find a growth company run by a charismatic genius, buy it at any price, and profit.

Ownership

The value of legacy:

People like to complain about their families. But when it comes to making money, it’s the family-owned businesses that seem to be doing it best. … Credit Suisse’s portfolio of family-owned companies have outperformed most other equity markets by an annual average of around 400 basis points per year.

Longevity

Why cities survive and companies die:

The fact that companies scale sublinearly, rather than superlinearly like cities, suggests that they epitomize the triumph of economies of scale over innovation and idea creation. Companies typically operate as highly constrained top-down organizations that strive to increase efficiency of production and minimize operational costs so as to maximize profits. In contrast, cities embody the triumph of innovation over the hegemony of economies of scale.

Diversification

How Fred Wilson invests:

I like a mix of cash (t-bills, money market funds, etc), blue chips stocks (Amazon, Google, etc), real estate (income producing with little to no leverage), and a risk bucket (venture capital, crypto, etc). I think 25% in each would be a good mix. We have more in the risk bucket but I am in the VC business professionally and have been for 30+ years. 25% in each is where I’d like to get to in time.

Have a good weekend.