What We’re Reading

Here are a few good articles the Collaborative Fund team came across this week.

What’d you expect me to do?

“Incentives are everything” Jason Trennert writes:

Ten years in business has taught all of us that people do almost precisely what they are incentivized to do. Get the incentives right, and wonderful outcomes will follow that require little management oversight. Get them wrong, and people will give you exactly what you asked for regardless of whether it’s in the long-term interest of the company. Even if there were someone smart enough to try to “fix” this universally human reality (and I sincerely doubt such a person exists here on Earth), management would find their time much more efficiently allocated to creating the correct incentives in the first place.

Plan B

Waiter’s Pad writes an excellent post on roleplaying:

Gene Kranz, a flight director from the Mercury through Apollo programs wrote about the simulations they did to get into space, take people through space, and land on the moon.

- Once Kranz arrived at his office and was told he had ‘been in a car accident’ on the way and had to sit out the training runs that day. Everyone else stepped into a new role.

- In another simulation a communication director based in Hawaii ‘had a heart attack’ and only after the simulation was over did Kranz learn it wasn’t true.

- On the final day of simulations before the Apollo 11, a day that typically ended on a high note to encourage self belief, simulation threw Kranz’s crew error code “1202.” Kranz ordered an abort. It was the wrong call, but a good simulation. That code, which no one had seen before, came up during the actual lunar descent.

Planning for disappointment

The Marc Andreessen career guide is excellent:

The world is an incredibly complex place and everything is changing all the time. You can’t plan your career because you have no idea what’s going to happen in the future. You have no idea what industries you’ll enter, what companies you’ll work for, what roles you’ll have, where you’ll live, or what you will ultimately contribute to the world. You’ll change, industries will change, the world will change, and you can’t possibly predict any of it.

Trying to plan your career is an exercise in futility that will only serve to frustrate you, and to blind you to the really significant opportunities that life will throw your way.

Career planning = career limiting.

The sooner you come to grips with that, the better.

Expectations

This Is Going to Be Big does a nice rundown of VC return expectations:

Do seed investors have Limited Partners with different return expectations than Series A and beyond investors? I’d say no–they’re taking money from the same endowments, high net worths and pension funds as everyone else. I’ve never heard any limited partner ask me if I can generate a better return than their Series A funds. So, if that was the case, and the market was competitive, why wouldn’t each VC be bidding up a round up until the point where they could get the return that matches their own cost of capital?

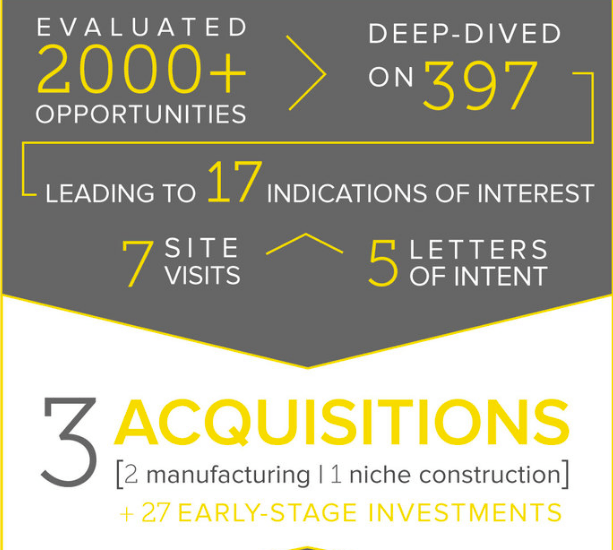

The funnel

Private investor Adventur.es shows how it went from evaluating 2,000 companies to closing three deals:

Carrying cost

This observation by Seth Godin is highly relevant to owning private companies:

I know what the price tag says. But what does it cost?

Does it need dry cleaning? What does it eat? How long does the training take?

What happens when it breaks? Where will I store it? What’s the productivity increase that justifies the ongoing expense?

How many staff hours does it take to support this new approach? How will it make me feel to tell other people that I own it? Do I need enhanced security or insurance? What happens to the operation when it goes down and needs to be replaced? What skills will I lose if I rely on this? Is it housebroken?

And, what’s the cost to all of us to produce it and then dispose of it when it’s done?

Missing the past

This is a great piece on nostalgia:

Believers in this fairy tale insist that back then – whenever then was – everyone felt content with their existence. Acknowledging that the real-life protagonists of golden age myths themselves pined for an earlier golden age would spoil the story, or at least ironise it. But they did.

Have a great weekend.