The Quiet Beverage Bet Outpacing AI Hype: How OLIPOP’s Investors Are Winning

OpenAI gets the headlines, but OLIPOP’s early backers are set to reap returns that prove MOIC lies in execution, not buzz.

If I told you a company was on track for $500M in sales in 2024 — up from $200M in 2023 and $70M in 2022 — and thriving thanks to massive secular tailwinds, what kind of business would you imagine? A cutting-edge AI company? What if I told you it was a soda company founded just five years ago in Oakland, California?

The flashiest companies don’t always deliver the highest returns for early investors. Let’s explore a comparison between two vastly different businesses: OpenAI and OLIPOP.

OpenAI is among the most influential and widely discussed companies in the world, and for good reason. It ushered in a golden age of LLMs, with staggering ripple effects: skyrocketing AI-related CapEx among tech giants, NVIDIA’s ascent to the world’s most valuable company by market cap (though it now ranks #3), and a dramatic resurgence in U.S. power demand growth.

Then there’s OLIPOP – a soda company. But not just any soda. OLIPOP makes a healthier alternative with gut-friendly prebiotics and plant fiber. Its nostalgic flavors, like Classic Root Beer and Vintage Cola, feel indulgent but deliver a BFY experience. It’s also delicious. Simple as that.

Comparison methodology

To compare the investment performance of OpenAI and OLIPOP’s first investors, we’ll use a simple returns multiple: the current value of their ownership divided by their initial investment. Since both companies raised their first rounds in 2019, this approach allows for a direct comparison, even though it doesn’t factor in timing (e.g., IRR).

For simplicity, we assume early investors did not participate in later rounds and were diluted. To calculate these returns, we need to determine:

- Size and valuation of each company’s initial equity round

- Sizes and valuations of subsequent rounds to account for dilution

- A reasonable estimate of their current valuations

- A projection of future dilution each company may face before exit

OpenAI’s returns

Founded in 2015 as a nonprofit focused on advancing AI safely, OpenAI restructured in 2019 to fund its expensive pursuit of AGI. It created OpenAI LP, a “capped-profit” entity governed by the original nonprofit (renamed OpenAI Nonprofit). This structure allowed OpenAI to raise private capital while capping early investor returns at 100x, with any excess profits flowing back to the nonprofit.

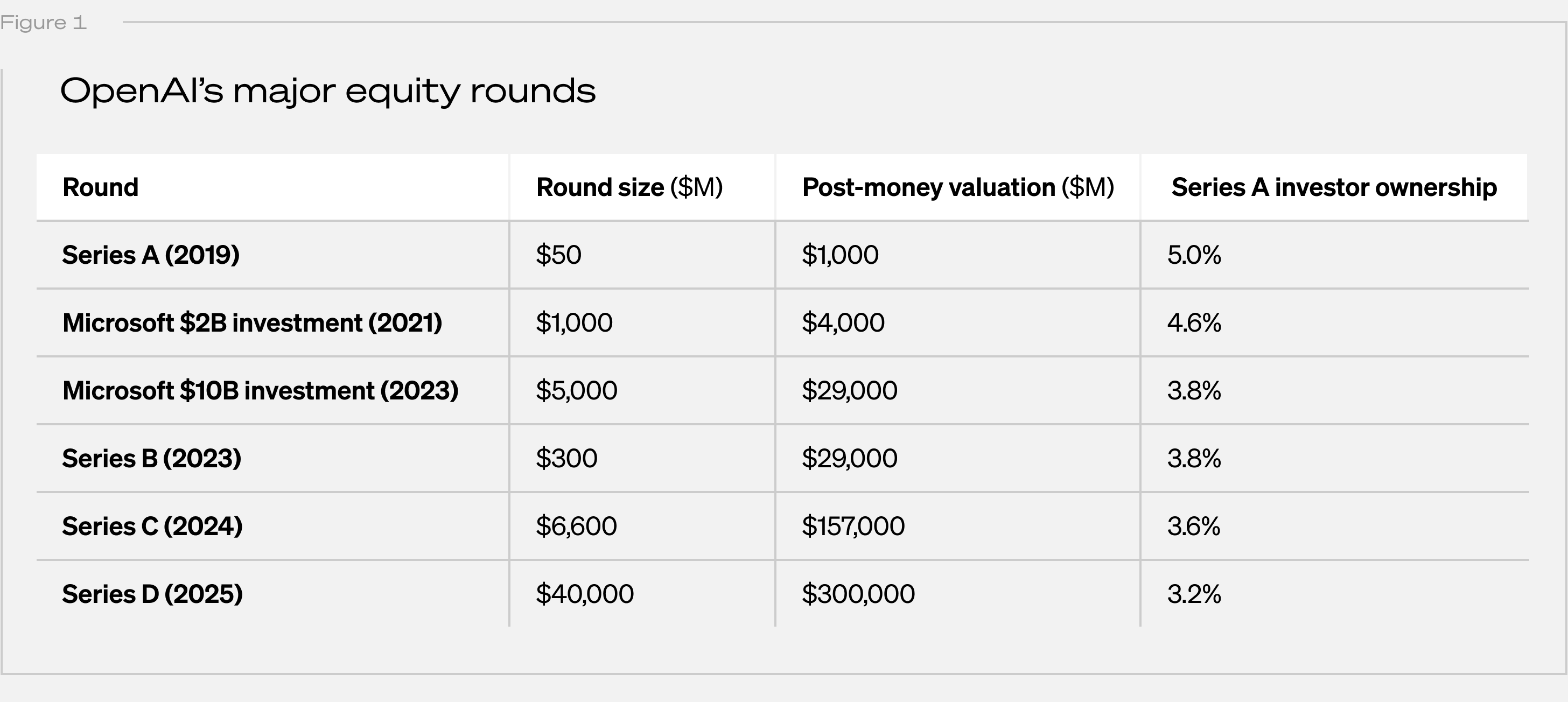

At the time of this change, OpenAI also announced its first institutional funding round, led by Khosla Ventures. Let’s call this their Series A. Details remain unclear: PitchBook lists it as a $10M raise at an undisclosed valuation, while other sources suggest Khosla’s stake alone was $50M at a post-money valuation of $1B. We’ll assume a round size of $50M for 5% ownership.

Estimating dilution is tricky. Most of OpenAI’s funding post-Series A has been from Microsoft, which has poured in ~$14B through a mix of equity, Azure credits, and unique profit-sharing agreements. Sources disagree on the details, but key reported investments include $2B in 2021 and $10B in 2023. Adding to the complexity, OpenAI is now transitioning to a for-profit public benefit corporation, which could eliminate the 100x cap on early investor returns.

To simplify, we’ll assume:

- OpenAI completes its transition, removing the 100x cap.

- Half of Microsoft’s 2021 and 2023 investments were dilutive, with valuations of $14B in 2021 and $29B in 2023 (as suggested here).

Beyond Microsoft, OpenAI raised a $300M round in 2023 at ~$29B (Series B) and a $6.6B round in 2024 at $157B (Series C). Just yesterday, WSJ reported that OpenAI is in talks for a $40B round at a whopping $300B valuation (Series D). If this round closes as reported, Series A investors will be diluted from 5% to 3.2%, as shown in the table below.

At a $300B valuation, that 3.2% stake is now worth $9.5B – a 189x return on their initial $50M. Not bad!

OLIPOP’s returns

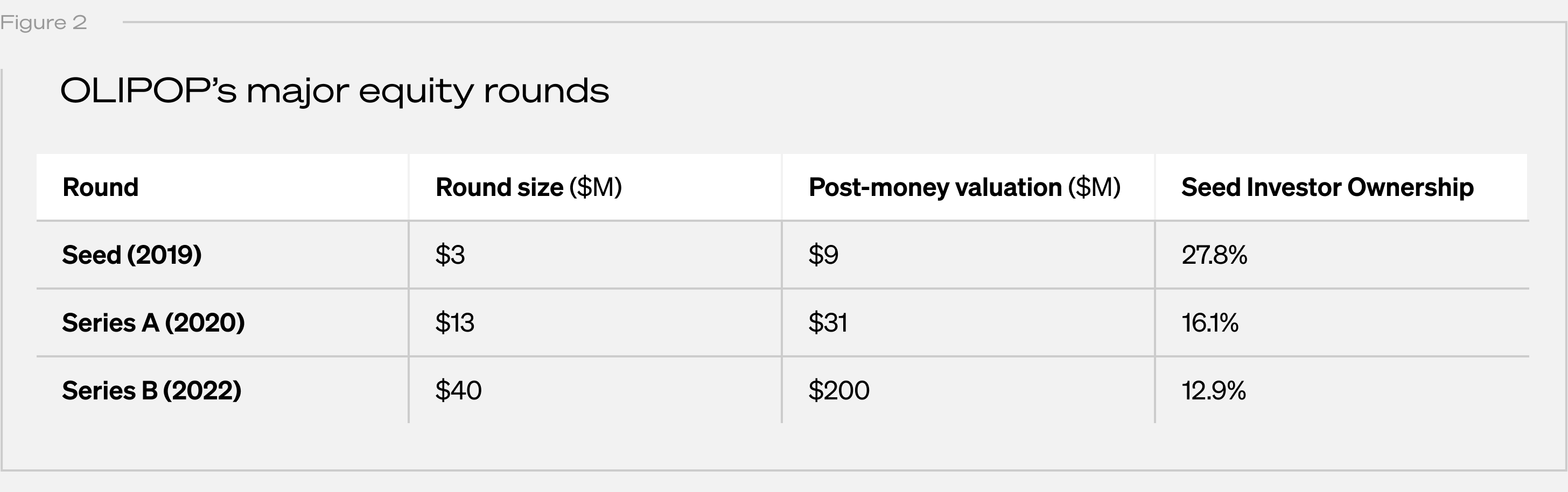

OLIPOP’s story is far more straightforward. PitchBook shows its major funding rounds below:

OLIPOP’s seed investors have been diluted from an initial 28% ownership to roughly 13% today. The last disclosed valuation was during its 2022 Series B, but OLIPOP has grown significantly since then. To estimate its current valuation, we apply a forward revenue multiple from a public comparable to its projected next-twelve-months (NTM) revenue.

OLIPOP’s revenue growth has been remarkable, with several sources indicating it was on track for $500M in 2024 sales, up from $200M in 2023, and $73.4M in 2022. Extrapolating this 2022-2024 CAGR, we estimate NTM revenue of $1.3B. This projection seems reasonable, as revenue growth has shown little sign of slowing, and OLIPOP has significant room to expand distribution and retail presence.

Celsius Holdings (CELH), the maker of CELSIUS energy drinks, offers one of the only relevant public comparables. Applying their 3.8x forward revenue multiple to OLIPOP’s estimated NTM revenue yields an implied valuation of $5.0B.

At this valuation, seed investors’ 13% stake would be worth $639M – an astonishing 256x return on their $2.5M investment, outperforming even the 189x return estimated for OpenAI’s Series A investors.

Future dilution

While current valuations provide a snapshot, returns are realized at the point of liquidity. OLIPOP not only appears likely to deliver higher returns than OpenAI based on current valuations, but is also likely to experience less dilution – and the resulting erosion of returns multiples – before exit. To assess dilution risk, we must evaluate how much additional capital each will need to reach self-sufficiency, where revenues consistently cover operating and capital expenses. Ultimately, this hinges on the strength of each company’s unit economics.

OpenAI’s unit economics

OpenAI’s two primary revenue streams — ChatGPT subscriptions and API usage — present distinct unit economic profiles and associated challenges.

ChatGPT Subscriptions

OpenAI offers several subscription tiers, from a free plan with limited features to a $200/month “Pro” plan. While paid tiers generate predictable monthly revenue, inference compute costs scale with user activity, which can be unpredictable. This means new users don’t always equate to profit growth. This challenge is exemplified by recent reports that OpenAI is losing money on GPT Pro users due to unexpectedly high inference costs, despite the $200/month price point, which Altman set with profitability in mind.

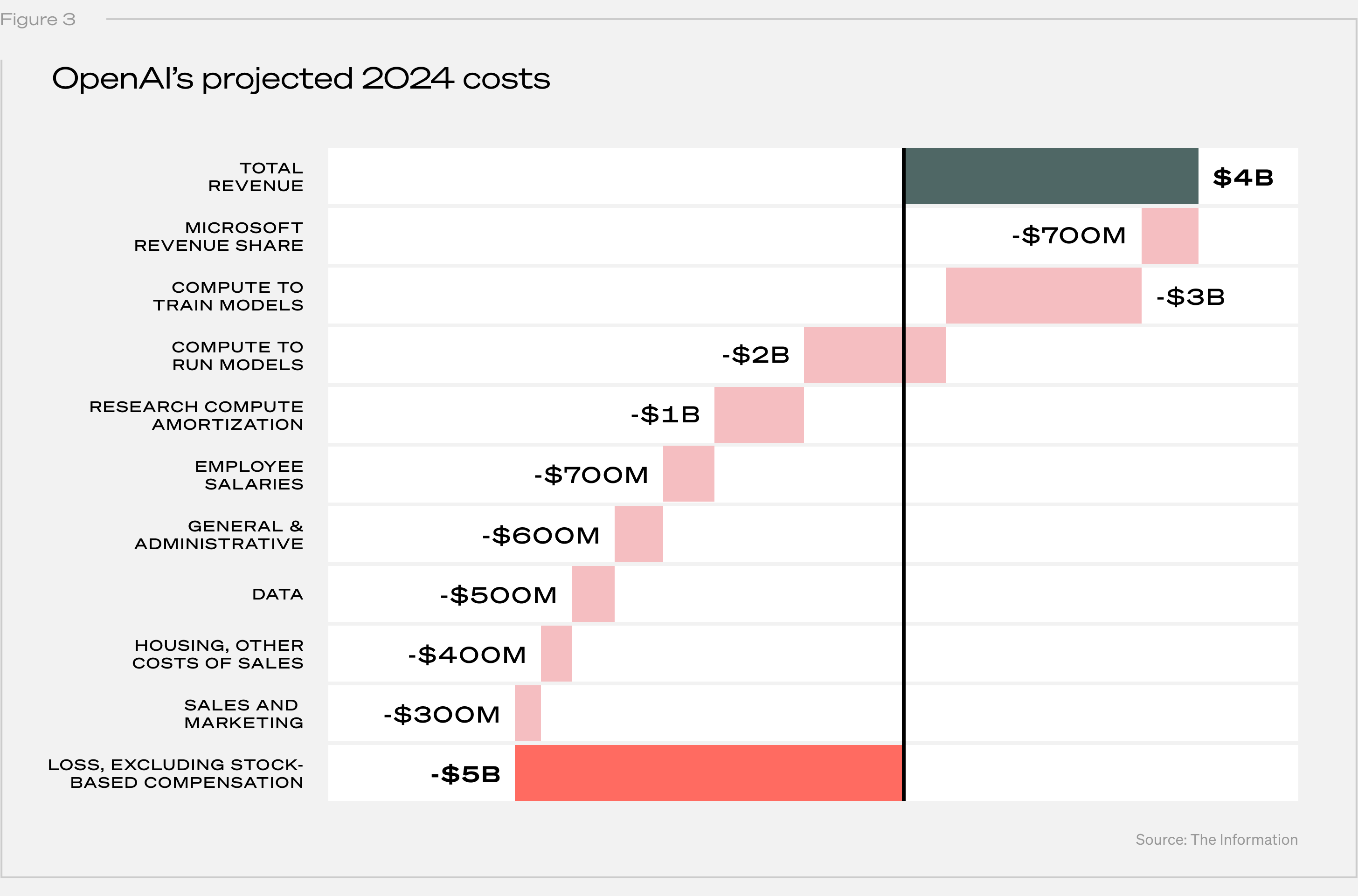

This issue is further exacerbated by the overwhelming proportion of free-tier users – estimated at 95% – who incur inference costs without generating revenue. As a result, paying users effectively subsidize these expenses. Inference compute costs for 2024 were projected at $2B, compared to an estimated $4B in total revenue.

API Usage

The API’s pay-per-token model better aligns revenue with costs, but rising competition has eroded OpenAI’s pricing power. Token prices have plunged 89% in just 17 months, dropping from $36 per million tokens at GPT-4’s launch in March 2023 to $4 by August 2024. DeepSeek, which recently demonstrated that training and inference can be far less compute-intensive, has only accelerated this price collapse. Its reasoning and chat models are currently priced over 95% lower than OpenAI’s.

Training, while not directly tied to unit economics since it doesn’t scale with usage, remains a significant and growing financial burden. Costs are projected to reach $9.5B annually by 2026, with R&D expenses climbing from $1B in 2024 to over $5B in 2026. Though these projections predate DeepSeek’s breakthroughs in cost-efficient training, training will undoubtedly remain a massive and essential expense for sustaining AI leadership.

The following chart illustrates how high inference and training costs, a large base of free-tier users, and pricing pressures combine to create significant profitability challenges.

Training compute costs for 2024 were projected at $3B, with inference costs adding another $2B. Combined with Microsoft’s $700M revenue share and substantial operational expenses, these factors contribute to an estimated $5B loss for 2024, excluding stock-based compensation. These losses are expected to continue, with OpenAI projecting $44B in cumulative losses from 2023 to 2028. Profitability is targeted by 2029, with a revenue goal of $100B.

Covering these massive losses has required successive capital raises, most recently the $40B round, further diluting investors. If OpenAI’s $44B in projected losses through 2028 proves accurate, this latest capital infusion would have brought it close to self-sufficiency. However, a substantial portion of this round is reportedly allocated to OpenAI’s $19B commitment to President Trump’s $500B Stargate initiative, leaving a funding gap. As a result, more funding rounds and investor dilution are likely.

OLIPOP’s unit economics

OLIPOP benefits from straightforward unit economics, driven by predictable production and distribution costs in the established soda industry. Key variable costs include raw ingredients, packaging, co-packing fees, and freight, while fixed costs cover overhead, staff, brand marketing, and R&D. Unlike OpenAI, OLIPOP doesn’t require massive upfront capital or speculative R&D. Its differentiated formulation, brand identity, and consumer positioning also help shield it from commoditization risks despite competition from peers like POPPI.

Regarding future dilution, OLIPOP is already fully profitable. While the company is likely to raise additional capital to accelerate growth, they don’t need to. This gives a more flexible path to exit – OLIPOP could sell to a strategic buyer or IPO without the pressure of hitting complex, multi-year milestones. Fewer funding rounds, less dilution, and a profitable business model mean early OLIPOP investors are far less exposed to the risk of a delayed exit and ownership erosion over time.

Final thoughts

These returns underscore an important lesson: less flashy businesses can sometimes outperform even the most hyped tech companies. This is largely driven by the importance of entry price – achieving a 256x return is far more feasible from a $2.5M starting valuation than from $1B – as well as the path to profitability and the unit economics that pave the way.

While OpenAI is revolutionizing industries, OLIPOP is quietly dominating its category, proving that exceptional returns don’t always come from the highest-profile companies. For investors, the takeaway is clear – entry price and timing are critical, but so is recognizing opportunity in unexpected places.

Finally, full disclosure – Collaborative Fund is a Seed investor in OLIPOP – an investment made before I joined the team. Credit goes to my colleagues for identifying the opportunity early, and even more to the OLIPOP team for consistently exceeding expectations.

If this has left you craving OLIPOP or curious to learn more, you can check them out here. My favorite flavor is Vintage Cola.