Back to School

The beginning of a new school year is a unique time in every kid’s life. A time full of expectations, and equal amounts of trepidation and excitement. The same could be said for their parents, which is why I was struck by this list of suggestions that a lower school head wrote for a back-to-school night.

Parents,

A few suggestions for the upcoming school year:

1. Try to remain objective about your child and realistic about your expectations. We are not talking here about loving your child any less — just about viewing his strengths and limitations in a realistic way.

2. Keep yourself well-informed and open to the observations of others about your child. Such people as teachers and coaches can provide you with valuable pieces of information, and you need to take the time to listen.

3. Accept “bad news” as a problem to be dealt with. Do everything you can to keep yourself from overreacting. Keep calm and think! Remember that even we parents have made a mistake or two along the way.

4. Listen carefully to your children, but make the distinction between listening to them and agreeing with them. Kids are good at conveying a perspective. Don’t succumb to the temptation to equate the child’s perspective with “the truth.”

5. Leave the child some unscheduled time. You would be surprised to see the number of kids who can’t seem to do anything unless it’s been planned and scheduled for them. Remember the old days when we had to determine for ourselves some of the things we were going to do with our time.

6. Act consistently over time; and, mothers and fathers, act together. Don’t make empty threats. Don’t let children play off one parent against the other.

Our main goal is to help your child develop into an intelligent, thoughtful, compassionate, contributing adult — a person who years from now is able to say to themselves: “I have the capacity to make sound decisions and to work through obstacles on my own.” The decisions you make along the way can serve either to enhance or reduce the probability that the goal will be reached.

For any parent who read this, it probably resonated. It did for me at least.

Now, what if I let you in on a little secret?

What if I told you this was written in 1992??

I’ll be honest, when I first read it, I was both surprised and relieved. Surprised because it is almost exactly what I would expect a head of school to suggest for parents in 2025. Relieved because it is a reminder that one thing that never changes over time is human behavior.

While this list pertains to how we parent our kids, it could apply to many other things in life — including business and investing.

#1 — Remain objective and realistic about your expectations

Parents have wrestled with this challenge for generations, and likely always will. It’s only natural to want the best for our children, and to want the best from them as well. Yet the truth is, true greatness is the exception, not the rule. However, recognizing that reality feels harder today than ever before.

The reason?

In part because social media’s curated clips of kids scoring goals, acing tests, mastering instruments, and winning awards convince parents that their own kids are lagging. They subsequently pile on more coaching, tutoring, and specialization, which unfortunately has a better chance of breeding burnout than greatness.

Many investors today are suffering from something similar, evidenced by the rise in the popularity of riskier investments like private equity, leveraged ETFs, and crypto, while others are increasingly falling for “get-rich-quick” schemes.

Why?

For the same reasons parents lose their objectiveness. Whether it’s seeing Jeff Bezos on his yacht, the women in The Real Housewives of Name that City, or social media photos of people on vacation in exotic locales, many people feel they have missed out on the outsized returns over the past decade and are trying to catch up.

This is precisely the reason the late Charlie Munger said, “it’s not greed that drives the world, it’s envy.”

The trouble is that when people take outsized risks at this stage of a cycle, it almost always doesn’t end well.

#2 — Stay well-informed and open to observations

Being “well-informed” seems to mean something different than it used to, in large part due to the speed at which information travels. For parents, it used to mean knowing their kids’ general whereabouts and trusting they’d be home by dark. Now, it involves tracking their every move with GPS. As for openness to feedback, since many now take offense, teachers and coaches often hesitate to provide it, hindering kids’ growth.

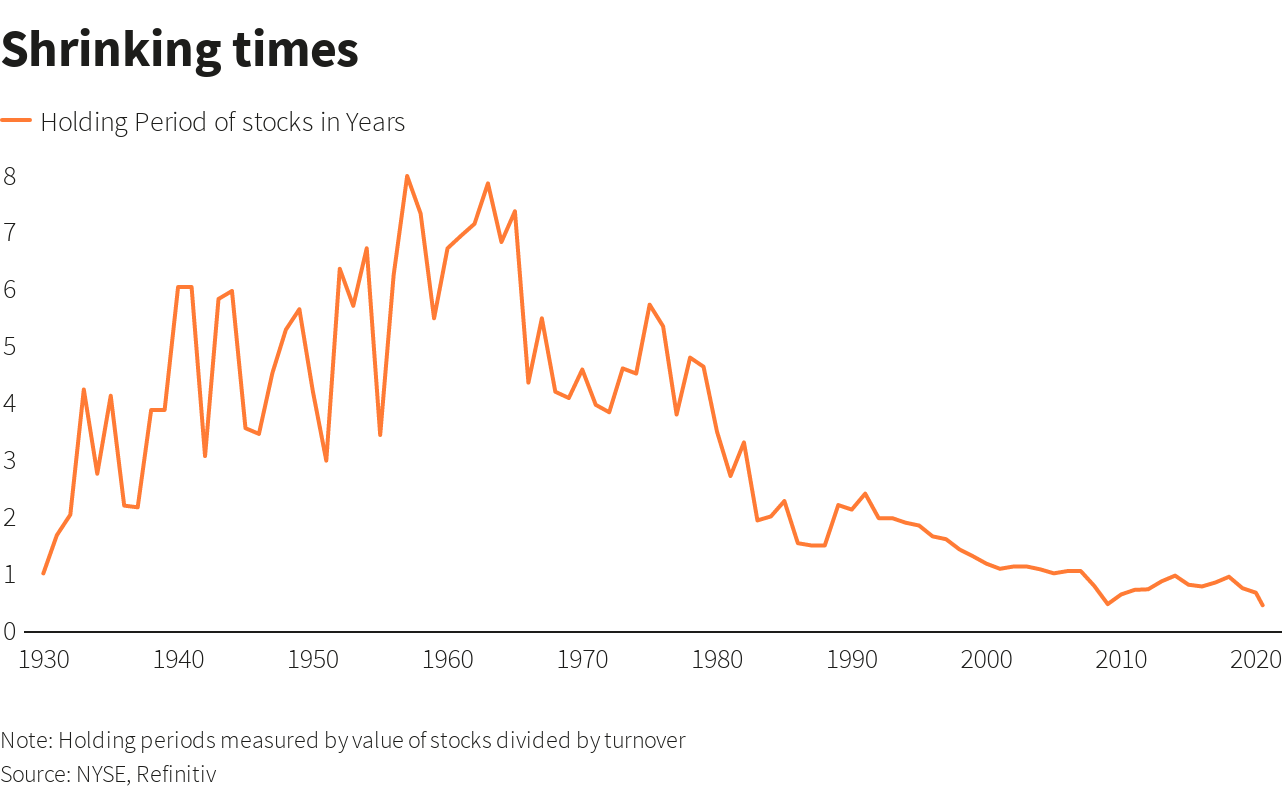

For investors, it used to mean being well-read and having a good sense of where the world was headed. Today, it too often means being aware of what is happening every minute of every hour of every day through outlets like Twitter and Bloomberg. Unfortunately, this deluge of information has made many “miss the forest for the trees,” leading to increased turnover and worse performance.

#3 — Accept “bad news” as a problem to be dealt with and don’t overreact

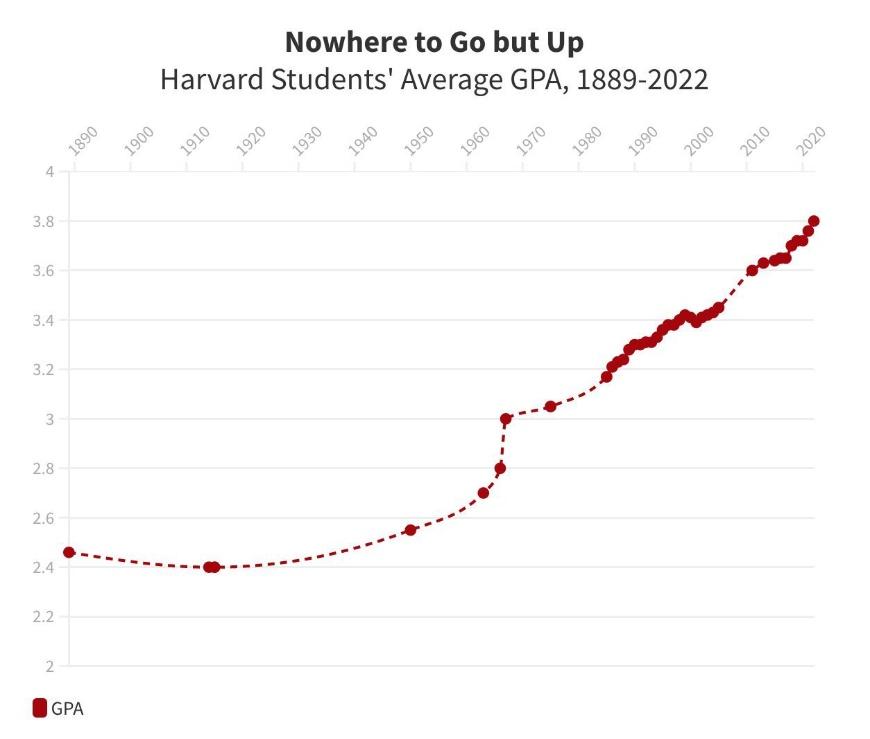

An inability to accept that bad grades are a part of life has led to one of the greatest overreactions in the history of education — grade inflation.

The result?

No one knows how kids are truly doing, notably colleges and employers. As a result, to gain admission, kids feel like they need to differentiate themselves in other ways, so they overload on countless activities outside of school. Yet, GPAs are still higher than ever.

Investors hate bad news too, only instead of grade inflation, we have experimented with illiquidity as a solution to the volatility created by negative headlines in public markets. The problem is, volatility is often what creates the best investment opportunities, at least for those able to take advantage of it. Given this push for illiquidity has become so widespread, we are just beginning to witness the side effects.

#4 — Listen carefully, but make the distinction between listening and agreeing

Listening and agreeing are vastly different things. Personally, with a nine- and seven-year-old at home who have been increasingly stretching the truth, I do a lot more listening than agreeing, but I imagine this will get more nuanced the older they get. In my experience, the best investors listen to everyone, but for a different reason than you might expect — they listen in order to determine what the current consensus is. Once they do, they often start leaning the other way…i.e., they don’t agree.

#5 — Leave the child some unscheduled time

Everyone knows our kids are overscheduled (see the consequence of grade inflation). After all, when getting into the best college or being offered a great first job is the “end-all-be-all” and only possible with endless activities, what do you expect? Yet, kids are more overwhelmed, anxious, and stressed out than ever.

As for markets, Morgan Housel has often said that his best thinking occurs when he goes for a walk. No iPhone. No podcasts. No music. Just himself walking. Try it.

#6 — Act consistently over time when parenting

As a dad, I will fully admit that I am not great at this. I have been known to threaten a punishment – “we’re leaving if you don’t stop doing that!” – but then back down, likely because I personally don’t want to leave. The problem is my kids have caught onto this and it’s a problem because like Clint Eastwood in Sudden Impact, they now call my bluff.

Most investors are equally poor at this. They are value investors one day, growth the next. Fans of active managers today, and passive tomorrow. In love with private equity, then out of it. Either way, the most reliable path to success is consistency. Pick one strategy and stick to it. Don’t flip flop, especially now. If you’ve held international equities for the past decade, I wouldn’t bail now. If you’re late to the game on private equity and considering an allocation, make sure you’re capable to sustaining new commitments for years to come. If you’re thinking about scrubbing any commodity or energy exposure you have left, I actually might consider adding instead.

So where does this leave us?

The fact is, as much as we tell ourselves that things are vastly different than they were a few decades ago, the reality is they aren’t. Sure, the world is faster, noisier, and more competitive, but the core tenets of a good life — or a resilient portfolio — haven’t changed. In fact, they might matter more than ever. Namely, as this lower school head suggested — keep your expectations in check, stay well-informed (but not too informed), avoid over-reacting, listen carefully, and remain consistent. Simple on paper. Hard in practice. Timeless for sure.

For all parents and kids out there, good luck in the new school year. I know I’ll need it.

For investors, I’ll say the same thing — good luck…we all need it.