Be Curious

Guest post by Ted Lamade, Managing Director at The Carnegie Institution for Science

There is a great scene in the first season of Ted Lasso in which the show’s antagonist, Rupert Mannion, challenges Lasso to a game of darts. After seeing him make a few poor throws, Mannion is confident that it is easy money. The two play and Mannion appears to be on the verge of winning with Lasso needing two “triple 20s” and a bullseye on his final three shots. Then, just before he throws his darts, Lasso turns to Mannion and says in his Southern drawl,

“You know Rupert, guys have underestimated me my entire life. It used to really bother me, but then one day I was driving my little boy to school and saw a quote by Walt Whitman painted on a wall that said, ‘Be curious, not judgmental’. I liked that. See all those fellas who belittled me, none of them were curious. They thought they had everything figured out. So, they judged everything* and everyone*. And then I realized that their underestimating me had nothing to do with it…..because if they were curious, they would have asked questions. Questions like, ‘Have you played a lot of darts Ted?’ Which I would have answered, ‘Yes sir. Every Sunday afternoon at a sports bar with my father from age 10 until I was 16 until he passed away’.”

Lasso proceeds to drill all three shots and wins the game (watch the scene on YouTube if you have a minute). In short, a hustler got hustled because he wasn’t curious enough. He made judgements based on incorrect assumptions and didn’t ask the right questions

Being curious is one of life’s most underappreciated qualities. It’s an admission that you don’t have it all figured out. It means you’re willing to listen and learn. Most importantly, it often differentiates the good from the great.

The Innovators

Ted Lasso is a work of fiction, but this concept of curiosity is not. Look no further than what Walter Isaacson said was the most common trait he observed in the people he wrote about in his book “The Innovators”.

“Curiosity. Pure, passionate, and playful curiosity about everything. Steve Jobs was curious about calligraphy and coding, while Da Vinci was curious about art and anatomy. They wanted to know everything about everything that was knowable. Ben Franklin wanted to know about science, the humanities and poetry. Even Einstein wanted to understand Mozart at the same time that he studied general relativity. Curiosity leads to an interest in all sorts of disciplines, which means you can stand at the intersection of the arts and sciences, which is where creativity occurs. A wide range in curiosity allows you to see patterns exist across nature and how those patterns ripple.”

Roelof Botha of Sequoia Capital echoed a similar sentiment in a recent podcast when asked about the most important characteristic of a venture capital investor.

“The most important thing is curiosity. Are you interested in learning about new things? Are you interested in meeting new people? Are you interested in listening to their ideas about a company and how they are going to change the world? If not, or if you lose this curiosity, then you become jaded and you should probably stop being an investor.”

These days everyone is looking for an “edge”, which many pursue through specialization. In certain cases, this is a very positive development. I think we can all agree that we would prefer to have surgeons who specialize in specific parts of the body as opposed to those who will operate on any part. Yet, if Isaacson and Botha are right, when it comes to fields such as entrepreneurship, business, and investing, hyper-specialization is likely not ideal. Why? Because doing so dampens curiosity.

With that in mind, in an effort to channel my “inner Lasso”, here are a few things I am curious about heading into 2022.

More Data = Worse Forecasts?

In a world overflowing with data, why are forecasts worse than ever? Just think about the past few years. Nearly every Covid-19 prediction has been off the mark — from its severity and virality to vaccine efficacy and the way equity markets would react to the outbreak. Political predictions have been even worse – few had Joe Biden winning the Democratic nomination in 2020, Trump winning the presidency in 2016, or the Brits voting to leave the European Union that same year. Yet, investors still might be the worst – few had energy and financials leading the way in 2021, fewer thought the market would have doubled off the March 2020 lows, and no one has made an accurate interest rate call in years. Yet, these failed forecasts aren’t what concerns me. Our confidence in them does. For some reason, despite repeated futility, forecasters are more confident than ever these days. They have become *convinced *that more data is the equivalent of a crystal ball. Yet if even Albert Einstein admitted that, “the more I learn, the more I realize I don’t know,” this current confidence seems misplaced. Keep this in mind as you read people’s forecasts for 2022 equity market returns, the path ahead for inflation, the Midterm Elections, or the next Super Bowl Champion.

Is Ignorance Bliss?

Let’s say we could predict the future, would we even want to? Look no further than our health. Doctors are on the verge of being able to detect people’s genetic vulnerabilities to cancer well before it metastasizes and becomes life threatening. On one hand, this seems like an overwhelmingly positive development. But what if I told you doing so could also have severely negative psychological side effects? An article over the weekend in the Wall Street Journal titled “Will We all Soon Live in Cancerland?” highlights this risk and defines the people it could impact as “previvors”. The argument is that when people realize they are at risk of developing cancer, it can be all consuming and debilitating, even if they are never actually diagnosed with cancer. This new genetic mapping could create the fear that the threat of cancer will never go away—that it will always be there.

This is not limited to cancer. Just flip on the TV or search the internet today and you’ll realize that we are all becoming previvors of something — natural disasters, financial panics, viruses, and terrorism to name a few. The more information we are exposed to, the more we all become previvors.

What’s with the Metaverse?

How are we supposed to understand a world in which a virtual Mega Yacht sells for $650,000 in a virtual world called The Sandbox? The concept of the “Metaverse” has been around for a while, but it has received dramatically more attention in recent months with Facebook changing its name to Meta, podcasts increasingly have guests on to explain it (see Patrick O’Shaughnessy’s recent podcast), and yes, the media is hyping it. It feels a bit like crypto back in 2017. This said, I have no idea where the Metaverse is headed, but I do know this. Wherever it is going, it has considerable momentum and will likely play a large role in how we live our lives in the future. However, like most things that attract a lot of attention, capital, and smart people, it is going to be an incredibly bumpy ride for those that invest in it, and potentially society at large.

Business Travel

Most people have told me they are starting to travel again, but expect to travel a lot less than they did prior to Covid. Said another way, the bar for travel is higher. If so, what is going to get people over that bar? Speaking from personal experience, I am betting on unique experiences and people.

This past August I attended a conference in Columbia, Missouri that was unlike any other I have been to. It was called “Capital Camp” and was hosted by Brent Beshore (@BrentBeshore) and Patrick O’Shaughnessy (@patrick_oshag). In short, it felt like a food and music festival with an “investing overlay”. What truly differentiated it though was the people. It was one of the most unique groups I have ever been around. Since the conference, I have connected with at least two dozen people and have had a meal or drink with several others, which could potentially lead to a future investment. These are things you cannot replicate over Zoom. I could very well envision a world in which conferences or company gatherings like this bring people together periodically, then they disperse to their home offices or cities to grind away on the work.

Desperate for Capital and Returns

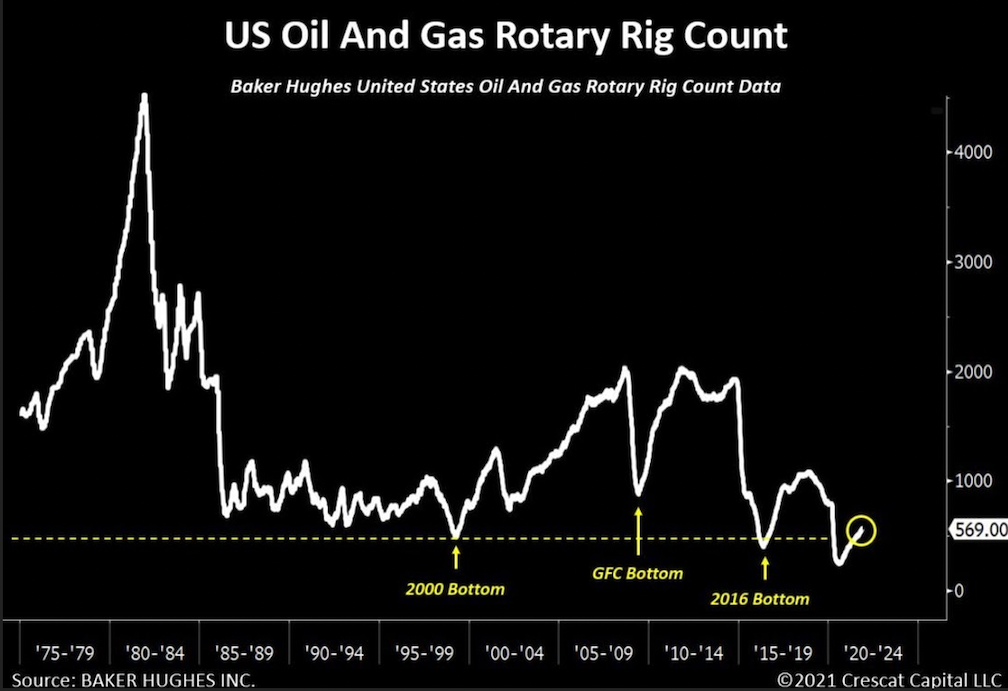

What do value investors and energy companies have in common these days? They’re unloved at best and hated at worst. As a result, their destinies might be linked. Why? They’re both desperate — energy companies for capital, value investors for returns. This desperation comes from the fact that large pools of capital have exited both en masse, in large part for justifiable reasons – namely poor performance and/or environmental reasons. Yet, the irony is that this may result in a massive opportunity for both. Why? Scarcity of capital has historically been a major catalyst for strong future returns.

The pattern goes something like this. A dearth of capital forces management teams to become more disciplined about capital allocation. As a result, they prioritize shareholder-friendly actions (dividends, buybacks, etc.) over capital expenditures. This subsequently leads to lower supply levels, a subsequent mismatch with demand, and an eventual rise in prices. When prices do rise, these businesses often become more profitable, so long as competition remains limited. We have already seen the early stages of this dynamic occurring in the energy complex, so given how badly value investors need to generate strong and differentiated returns, it wouldn’t surprise me if allocations to this sector begin to increase in a material way. As I have said before, this is looking increasingly like a Tobacco 2.0 scenario.

The Chinese Enigma

China continues to be an enigma. It has recently cracked down on several domestic industries, eliminated one entirely (for-profit education), restricted public listings in the U.S., silenced CEOs, increased its geopolitical “saber rattling”, and removed term limits from the man largely responsible for them. Yet it continues to be an engine for economic growth. Given this backdrop, what should we expect from China, its economy, its markets, and its relationship with the world going forward? I have heard a different explanation from nearly everyone I have spoken with, which makes me conclude that no one has a clue. My guess? China is still capable of producing large investment gains, but the risks have increased, potentially materially (which is ironic considering how much cheaper valuations are today). This said, it is important to remember that throughout history some of the best returns have come from investing in markets that are unloved (or even hated), opaque, and difficult to understand. If so, for those brave enough to add to or venture into China, maintaining humility and partnering with investors who truly understand the country’s nuances are more important than ever.

Baselines

Have you ever gotten frustrated when there is a Wifi outage on a plane? More importantly, have you ever asked yourself why? A decade ago, we could barely watch a decently streamed video on our home computers, yet today we get mad when we can’t send a Tweet or flip through phots on Instagram on a plane that is 36,000 feet in the sky. Once again, why? For the same reason portfolio losses feel so much worse than gains feel good, why Xi Jinping is so focused on making sure the Chinese middle class’s lives continue to get better, and why it’s so frustrating to lose yardage on your golf drives as you age.** Baselines.** As technology advances, portfolios increase in value, quality of life rises, and golf games improve, people raise their “baselines” and expect to maintain them. For investors today, most portfolios are close to all-time highs. This means their baselines are also close to all-time highs. The trouble is that with cracks emerging in some of the best performing parts of the market over the past 3-5 years (see high flying SaaS stocks trading at 15-20x sales as an example), many investors are starting to feel like their baselines are being impaired. If this continues, don’t be surprised to see irrational behavior ensue.

Rates and Inflation

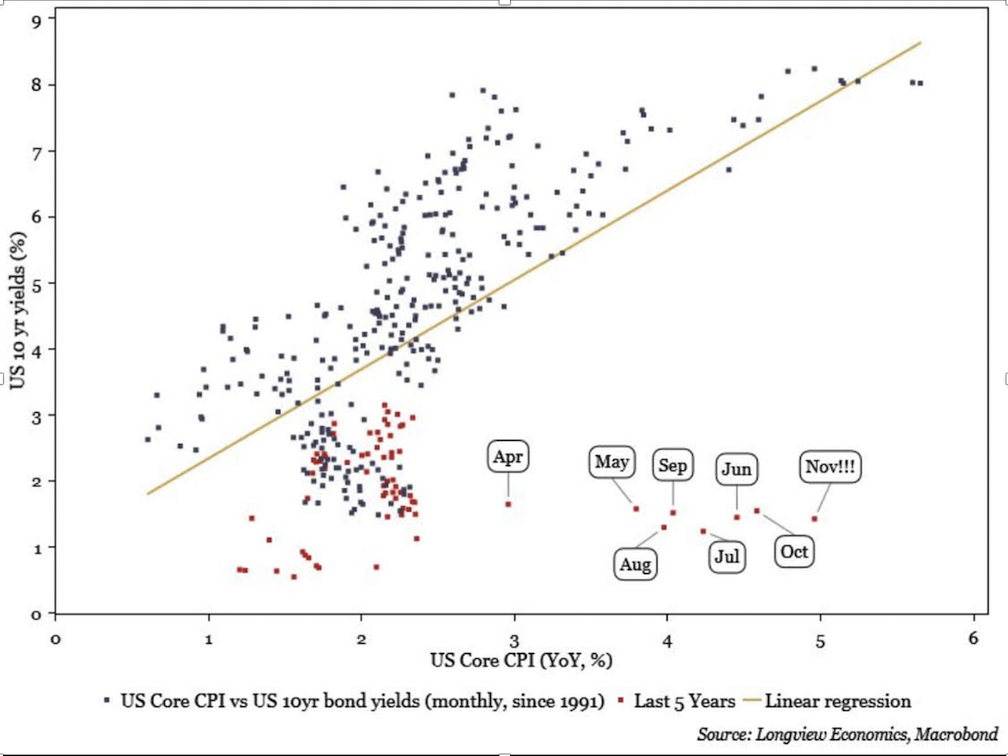

Interest rates are either headed higher or inflation is headed lower. That’s it. One or the other. These levels cannot hold indefinitely. My guess? Much like we see with jewelry when gold prices spike, we are likely witnessing a one time jump in prices that should hold even if inflation and commodity prices reverse course. If so, this could prove to be a nice bump in margins for many companies with pricing power. If not and inflation continues to rise, all bets are off.

CORE INFLATION (X-axis) vs. US 10 YEAR TREASURY YIELD (Y-axis)

Covid

It is hard to believe we are closing in on two years of Covid with cases of Omicron spiking. A lot of people are asking the question, “How does this end?” I keep going back to Ben Carlson’s post titled “The Power of the Human Spirit”. In it, he draws a parallel between Covid and the Nazis’ bombing of London during World War II. As Carlson writes,

“Germany bombed London mercilessly for two full years. They targeted supply chains, industrial targets, and the city at large. The hope was to demoralize the British population by bombing them day and night, including 57 days in a row at the outset. They dropped tens of thousands of bombs. Forty thousand people were killed and another forty-six thousand injured. The Germans damaged or destroyed buildings all across the region and decimated entire neighborhoods. More than a million people lost their homes. The British government had set up psychiatric hospitals outside of the city in preparation for the toll these bombings would take on their citizens. Yet something interesting happened. These hospitals sat empty. In the face of a war that was literally brought to their doorsteps, the majority of the people in London never panicked.”

Why did the Brits not panic? Why did the hospitals sit empty? The Brits simply learned to live with it. They had to. Life couldn’t grind to a halt. Plus, while many were killed or injured in the bombings, many more were not. This meant that the bombings created a generation of Brits that were even more emboldened. I would expect the same in the coming months and years. People will move on and learn to live with this virus, much like the Brits lived with the bombings. It might even embolden a few. It is simply human nature to endure.

College Football

College football is the definition of top heavy. Including this year, only thirteen teams have made the college football playoff since it’s inception seven years ago. One team has made it seven times (Alabama), another has made it six times (Clemson), and seven teams have made solo appearances. This essentially means that 90+% of programs have little-to-no chance of ever making it. Knowing this, is there a better way? Is there a system that would increase college football’s parity, excite more fan bases, and generate even more revenue? Yes, across the pond in the English Premier League’s relegation/promotion system.

What if college football’s ~125 teams were split into five divisions of 25 teams? Each division could play a season that concluded with a four team playoff and a champion. Following the season, the top five teams in each division could be “promoted” up and the bottom five teams would be “relegated” down. In this scenario, each team and fan base would be in contention for a championship whether they were in “Division 1” or “Division 5”, but they would also have the added carrot of being able to get promoted to higher divisions. Just a thought.

Why is Ted Lasso so popular?

Ted Lasso is one of the most popular and talked about shows on television today. An AFC Richmond jersey with brown mustaches was one of the most popular Halloween costumes this year and the show racked up more than twenty Emmy nominations. The question is, why? Personally, I never would have guessed that a show about a kind, yet corny, American football coach going over to coach an English football/soccer club would be this popular. Yet, the answer may be quite simple. People today seem to be *craving *leaders like Ted Lasso. After a long stretch of divisiveness, Lasso’s persona is refreshing and reminds us of a time when compromise was possible. If so, maybe there is a chance people will start favoring leaders who eschew the type of divisiveness we are surrounded by today. At least one can hope.

Lastly

So, what’s my takeaway from all of this? Walter Isaacson said in a recent interview that what separated Da Vinci, Franklin, and Jobs was not their intellect. It was their insatiable curiosity and desire to think about the countless things that other people stop noticing after a while. Unfortunately, it often feels like society is suffering from an extreme shortage of this curiosity these days. Ironically, in a world full of information, would one think that people would be *more *curious and *more *interested in learning about all sides of a topic, issue, or debate. Yet, it seems like most people prefer to seek out evidence that confirms their pre-existing beliefs.

As disheartening as this might sound on the surface, there may be a silver lining. Success often comes from leaning the other direction when things feel like they have shifted too far. Today might be one of those moments. A time to emulate Ted Lasso. A time to be a little more curious and less judgmental.