If Collaborative Fund Invested in Public Stocks

What if we could merge a private-markets mindset with public-market opportunities?

We’ve been talking about this around the office lately.

My partner Craig Shapiro wrote this eight years ago:

Buy 100 shares of Amazon and Netflix on the first of each month for the next 10 years. (starting September 1st 2010 – September 1st 2020).

His rationale was simple:

Jeff Bezos and Reed Hastings are great entrepreneurs. They are on the right side of the macro shift towards digital consumption and commerce; well capitalized, and haven’t enjoyed the spotlight Steve Jobs or Eric Schmidt have. I am long digital. I am long great products. I am long great leaders.

This worked, of course. It’s returned 21% annually since then, which would rank in the top quartile among venture funds in that vintage and would have outperformed the average hedge fund by more than 300 percentage points.

Yes, we have had one of the longest bull runs ever in the past eight years. Craig could have picked many different stocks and likely performed well. Or worse. That’s how this works.

But there’s a broader point here.

Craig’s picks were effectively merging a venture mindset with public market opportunities. Thesis-driven bets on bold founders made by investors with a structurally long time horizon is a big part of how venture works.

The latter point is the most important. Venture funds typically have 10-year lockups that enable long-term bets in ways most public equity funds realistically can’t pull off – especially with a concentrated allocation, where volatility can be higher. Netflix lost almost 80% of its value in 2011-2012. It’s nearly impossible to maintain investor support with those kind of temporary losses. But venture funds can take big bets on emerging trends with a high degree of uncertainty and volatility, because they are structurally long-term oriented. It is a benefit that never ceases to amaze me.

That sparked a question internally: If we invested in public stocks with the mindset and structure of a VC, what would we invest in?

Some background on how we invest now. This is a big part of our thesis:

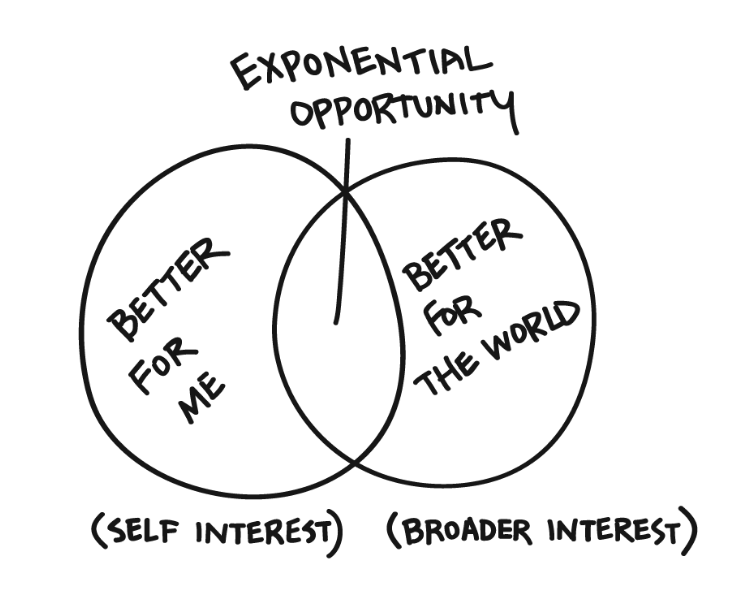

Within this diagram there are three areas of focus:

-

Collaboration as a disruptive force to existing industry and business models (Wikipedia vs. Encyclopedia Britannica)

-

Values as a competitive advantage (Tesla vs. Ford)

-

Focus on design and user experience in building an iconic brand (Airbnb vs. Hilton)

This has driven our venture investments for the last eight years, leading us to invest in companies like Lyft, Kickstarter, Quora, reddit, Blue Bottle Coffee, and Beyond Meat.

But our investment philosophy isn’t a venture capital strategy. It’s a trend that impacts virtually all businesses and all industries.

It comes down to this:

We believe shifts in demographics and consumer behavior will lead mission-driven companies to produce the highest economic returns in the coming decades.

People act differently in an interconnected world where everyone knows everything about you and you know everything about everyone else. Consumers are more attuned to how businesses operate than ever before. That’s made them more discerning about where they want to shop, who they want to work for, and what products they want to consume, for both personal and peer-approval reasons. People want to associate with companies that do good for them, and for the world, without sacrificing the product – Lyft’s gain on Uber in the last year is a good example. It’s a powerful trend. And it is as strong for big, established companies as it is for startups.

Here’s an example.

It’s the early 1990s. Costco is negotiating with a tire distributor.

The two hashed out a deal. It wasn’t particularly lucrative for the tire distributor, but Costco was a growing retailer with loyal customers, and tire companies were itching to get involved.

A week after the deal was signed, Costco called the distributor. They needed to renegotiate.

“I can’t renegotiate,” the tire distributor allegedly said. “I can’t go a penny lower on this deal without losing money.”

Yes, that was why the needed to renegotiate, Costco said.

After signing the deal Costco realized it was squeezing the tire distributor to the razor’s edge of unprofitability. It didn’t want a business partner in that position. So it tore up the original deal and raised the price it would pay for tires.

This was not altruism.

A business partner that can stick around for many years is worth more one that will have to be replaced in a year or two. A business partner who is taken care of is more likely to take care of you. A business partner that does well will give you less day-to-day hassle than one that feels suffocated.

This is obvious – but only if you can forgo maximizing short-term profits to focus on long-term rewards. Which is one of Costco’s enduring traits. “We want to build a company that will still be here 50 and 60 years from now,” founder and former CEO Jim Sinegal has said. “I think the biggest single thing that causes difficulty in the business world is the short-term view. We become obsessed with it.

This ethos goes beyond business relationships.

Costco pays employees an average of 72% more per hour than rival Sam’s Club. That is awesome for the employee. But it’s awesome for Costco, too. Its labor turnover is rock bottom: 17% per year for Costco vs. 44% for Sam’s Club. In 30 years, Costco has never had a major employee strike or protest. Hard to say this has come at the expense of shareholders: Costco stock is up more than seven-fold in the last 20 years, versus 2.5-fold for the S&P 500.

All business is hard. Picking investment winners is harder. But we look for patterns and companies that tilt in favor of those patterns. One pattern we’re increasingly optimistic on are companies doing right by others as a competitive advantage to do well for themselves. It’s a rare feat. But Costco has clearly done it.

If Collaborative Fund invested in public stocks, we’d invest in Costco.

Here are a few others well-known names we’d like to own.

Amazon

We could talk about Amazon’s potential to gain more retail market share (it’s currently only 4%), or its continuing opportunity in cloud computing, healthcare, and financial services. But something else goes unnoticed that makes us love Amazon: How much it has connected rural America to basic goods and services that used to be difficult to impossible to purchase. The ability to quickly and easily purchase a roll of Duct tape, or a tube of toothpaste, or a five-gallon bucket of hydraulic oil, is a boon to rural communities whose nearest major retailer could be dozens or hundreds of miles away. Jeff Bezos says he wants Prime to be a product that is irresponsible not to own. And he’s done that for millions of households who will be loyal customers for years to come.

Berkshire Hathaway

Buffett has built a compounding machine that will outlive his input by decades. The amount of admiration for Buffett’s investing skill can overlook what has actually been Berkshire’s competitive advantage for the last 20 years: A brand a reputation that is so superb that companies choose Berkshire as the acquiror they want to partner with. It is one of the only large-scale “private equity” shops that puts no thought into exits. That is incredibly valuable for family operators who need liquidity but don’t want to sacrifice their business’s dignity. Values as a competitive advantage.

Tesla

Building a car that reduces carbon emissions and aligns with 21st century energy ambitions is one thing. Building a car that is so beautiful and high-performance that those who don’t care about carbon emissions still line up to buy is truly something else. It is one of the purest examples of “better for me/better for the world” that exists. The amount of brand awareness it has built in one short decade is staggering for a company of its complexity.

Square

A dead simple, mobile-first banking solution that understands the evolving relationship between consumers and small businesses.

Tencent

WeChat isn’t just a messaging app; it’s the center of the universe for how people transact, find products, give recommendations, book a ride-share, and much more. And not just in China, but increasingly in other countries around the world.

Adobe

Enables the creative class more than almost any other technology product, and has managed the shift from single-purchase software to subscription cloud-based services with incredible success. Revenue grew 53% in the last two years, largely from products that have existed for years or even decades.

Netflix

Along with Amazon Prime, Netflix has created one of the only paid products that seems irresponsible not to own. If Prime is irresponsible to not own for financial reasons, Netflix has become irresponsible to not own for social reasons, staying connected to binding cultural trends in the post-cable TV world. The focus on original content will be seen as one of the shrewdest business moves ever, as Amazon ups generic content on Prime Video.

What if we asked you 10 years ago:

-

Do you think more or less people will be using Amazon in 2018?

-

Do you think Netflix can stream content and if so, will it be popular?

-

Do you think more people will be online and thus increasing search volume on Google?

These questions seem obvious. But lots of smart people overlooked this kind of thinking because they were too busy doing crazy amounts of work to try and determine how stock prices would move over a given month, or quarter.

Hindsight bias does not escape us. The bigger point is that few hedge funds or mutual funds could even attempt the kind of strategy Craig proposed – or even a more diversified one – because the ebbs of flows of interim volatility would have rankled investors. The combination of big bets on breakthrough companies and above-average holding periods from investors with structurally long-term commitments is rare, powerful, and deeply needed.

Private and public markets operate in totally different worlds, but both have traits the other can learn from and leverage off of.

Risk is How Much Time You Need

The New Business Strategy: Be A Little Nicer To Everyone

Collaborative Fund team members own shares in companies mentioned in this article.