The Playbook

Guest post by Ted Lamade, Managing Director at The Carnegie Institution for Science

Maverick is back and given the Top Gun sequel has raked in more than $800 million to date, it is already the biggest blockbuster of Tom Cruise’s career. A lot has changed since the original nearly four decades ago, but the secret to its success lies in what hasn’t changed — its “playbook.”

When one of the movie’s producers recently described how his team approached the script, he highlighted a conversation he had with Cruise shortly before the project started. The message was clear. Cruise said,

“This is a competition film. It’s about family, emotion, and the characters. We have to stay true to the original.”

While the Top Gun sequel employed modern technology and implemented a plot to fit the times, Cruise knew that its ultimate success (or lack thereof) would boil down to how well it followed the playbook that made the original so successful. The producers executed on that vision.

Top Gun’s playbook is simple — appeal to the nostalgia of those who saw the movie in the theaters in the mid-80’s. Remind them of the time they bought their first aviators after seeing Maverick wear them on the runway at Miramar, echoed the line “you can be my wingman anytime”, and rolled down their car windows, cranked up the volume, and driven a little faster when Kenny Loggins’ “Danger Zone” came on the radio.

The journalist Rich Eisen said it better on his show a couple weeks ago after seeing the movie,

“I cannot tell you how awesome this movie is. It was spectacular. It made me feel like I was back in high school again in 1986. It was great. Just terrific. It gives you everything you want, everything you are hoping for. You get the sunrise over the tarmac, Cruise on a motorcycle, Kenny Loggins singing Danger Zone, and the script is straight out of the original Top Gun. The flying scenes are incredible and Cruise looks the same. You have to see it in the theater. It is everything you’d want out of a sequel. I was just flying man, literally and figuratively.”

The key to Top Gun’s playbook is that it did not require the perfect backdrop, environment, or ideal release date to be successful. After all, it has generated nearly a billion dollars at the box office despite Covid-19 still making parts of the country hesitant to attend the movies. It just needed to stick to the durable themes from the original script, echo those emotions, and highlight the characters in the film that reminded the viewers of Goose, Slider, Charlie, and others. It has done just that.

Investing Playbooks

The same is true for the most effective investment playbooks. They are not constrained by or dependent on a certain time period, geography, sector, or interest rate environment. Instead, they are effective across a wide variety of situations and circumstances.

Few in the investment world have implemented a better playbook than David Swensen. When Swensen took over Yale’s endowment in 1986, coincidentally just months before the original Top Gun was released, he believed the university could generate stronger returns with similar (or even less) risk by taking advantage of the “illiquidity premium” that existed in the private markets. As a result, over the next three decades he and his team transformed Yale’s endowment from one invested 100% in liquid securities to one that is nearly 70% illiquid today. It was such a novel concept that it even received a new moniker - “The Yale Model.”

Yet, while Yale’s “liquidity trade off” has been an integral part of the endowment’s strong performance, Swensen still did not consider it the “secret” to Yale’s success. If not, what has been?

People.

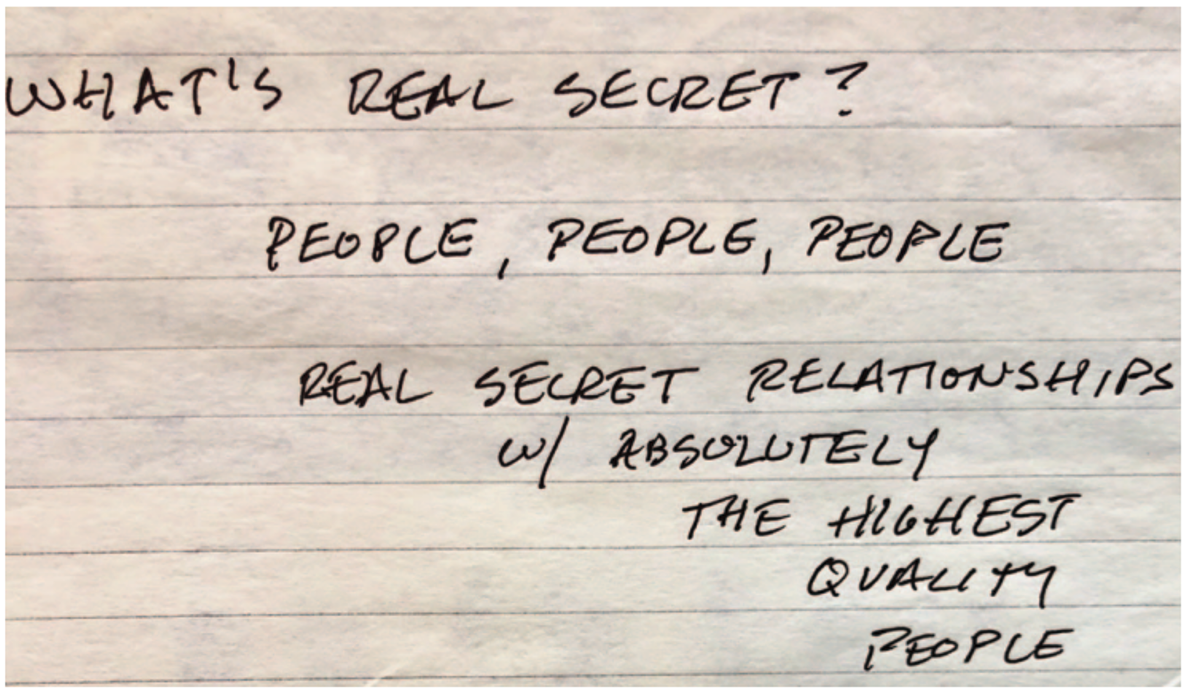

Sadly, Swensen passed away almost one year ago after a long battle with cancer. In a tribute to his life and career at Yale, the university dedicated its 2021 annual report exclusively to him. The report included a photo of an index card that Swensen had written on some years earlier as a reminder. It read,

Despite all of Yale’s sophisticated asset allocation decisions, quantitative investment analysis, and calculated portfolio adjustments, Swensen still defined Yale’s real secret as “People, People, People.” This applied not only to the people he invested with, but also to the people on his team, the students he taught, and the countless external charitable organizations he worked with (including my current employer). As Yale President Rick Levin said in the tribute, “The ‘Yale Model’s’ success for more than three decades was a function not just of analytical rigor, but also Swensen’s extraordinary judgment of people.”

The results speak for themselves. According to the annual report,

“When Swensen assumed management of the endowment in 1985, it stood at $1.3 billion. During his 36-year term as chief investment officer, his stewardship led to $57.6 billion of investment gains for Yale and more than $21.8 billion of spending to support Yale’s operations.”

This equates to an annualized gain of 13.7%, outperforming the average endowment (as measured by Cambridge Associates) by 3.4%. Without accounting for spending, $1 invested at the beginning of his tenure would have grown to nearly $103 by the end. By comparison, a dollar invested in the S&P 500 would be worth slightly more than $50.

Sounds like an effective playbook.

New Playbooks

Over the years, countless investors have attempted to copy Swensen’s playbook. In fact, the Yale Model has become synonymous with managing large pools of capital. Yet, the real indication of David Swensen’s legacy is the fact that today there are at least fourteen current CIOs at major institutions who worked for him.

One “alum” that has done an especially good job has been Seth Alexander at The Massachusetts Institute of Technology (“MIT”). Since joining MIT, Alexander has adopted a number or Swensen’s core principles, but has also created his own playbook by incorporating a number of his own unique principles. Namely, he and his team dedicate less attention to the traditional asset class silos (i.e., equities, fixed income, private equity, venture, etc.) and more on identifying managers that they believe will outperform regardless of what market, sector, or geography they operate in. Additionally, Alexander has flattened his team structure and broken down internal silos by making everyone a generalist.

This has manifested itself in Alexander’s decision to “favor duration over evidence”. This means that instead of focusing too heavily on an investor’s long-term track record, the team at MIT prioritizes identifying high quality people and investment teams well before they have appeared on others’ radars. He described the rationale recently on a “Going Long” podcast,

“We’ve come to a point where we err on the side of less evidence and more duration because the power of duration and long relationships is so powerful. If we can invest a piece of our endowment in a manager that’s relationship with us will last decades, that is a piece of the portfolio we don’t have to invest in every year (or five years). This then enables us to turn our attention to other parts of the portfolio. The more capital we can get into these parts of the portfolio that are working well, the more focus we can give to the rest of the portfolio and the higher quality decisions we can make because our attention is more focused. In a world that is often frenetic, the value of being able to only have to move a little bit of our capital each year is extraordinary.”

Finding a manager that’s “relationship with MIT will last decades” is another way of saying finding a manager that “Alexander and his team can trust implicitly”. Doing so then frees up more time for them to find additional people he can trust, invest more capital in them, and dedicate more time to making higher quality decisions.

The results speak for themselves as MIT has consistently posted some of the strongest returns among the endowment and foundation community (+11.7% for 15 years, +14.5% for 10 years, and +18.9% for 5 years).

People

I unfortunately never had the opportunity to meet David Swensen. Yet, I believe the reason why he wrote down the word “People” three times on that index card is because the most effective way to invest through both strong and difficult markets is to partner with high quality people. More importantly, high quality people who work well together as a team. Look no further than the article titled “All Stars: Is a great team more than the sum of its players? Complexity science reveals the role of strategy, synergy, swarming, and more.”

The authors, Jessica Flack of the Sante Fe Institute and Cade Massey of the Wharton School, highlight how the some of the greatest performance throughout history, be it The Manhattan Project, the Michael Jordan-era Chicago Bulls, or a chorus of frogs singing at night, are not due to each having the best individual scientist, basketball player, or amphibian. Rather, they are due to their synergistic interactions. “To how well strategies and individual attributes combine to produce team performance, individuals coordinate in space and time, and what roles leadership and larger organizational environments play in bringing out their best.”

Said another way, superior performance most often results comes from colleagues, teammates, and partners who make each other better. It’s why Robert Oppenheimer was only able to complete the most significant large-scale science project in history with the help of Leo Szilard and Leslie Groves, why Michael Jordan didn’t win an NBA title until players like Scottie Pippen and Steve Kerr showed up, and why a single frog singing in a field isn’t heard by a soul.

I write about this topic a lot because I find that nothing else in investing, or life for that matter, is more important. If you invest, partner, or work with people whom you trust and who compliment your skill set, it creates powerful synergies. From an investment perspective, as Seth Alexander highlighted, doing so enables you to comfortably commit capital that doesn’t need to be over analyzed, monitored, or scrutinized. This subsequently frees up more time to focus your attention and time on other things.

In a period like the one we are currently living through, one defined by increasing uncertainty, declining confidence, and an unclear road ahead, sticking to a proven playbook focused on high quality people is as important as ever.